NASSAU, BAHAMAS — The Opposition’s shadow finance minister yesterday dismissed the Davis administration’s touted revenue performance, arguing that it had inherited a growing economy from the previous administration.

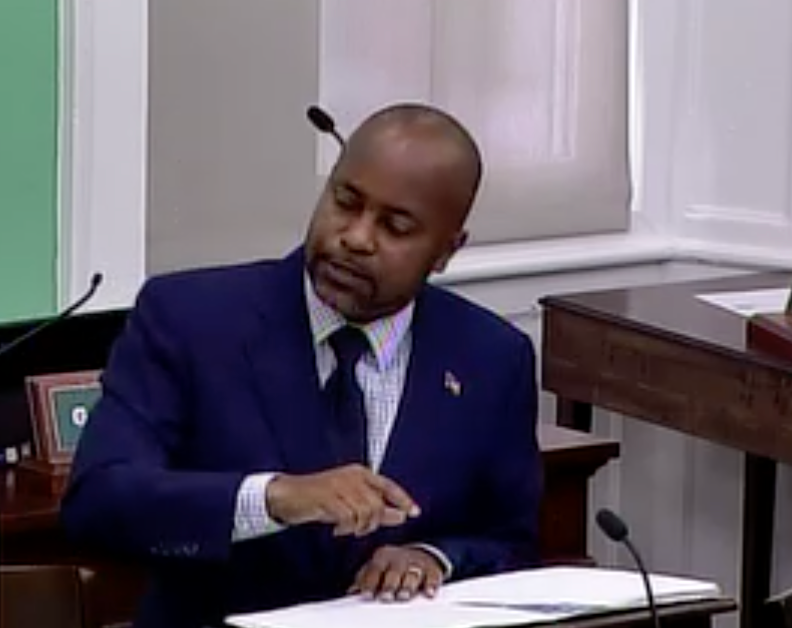

During his contribution to the mid-year budget debate, East Grand Bahama MP Kwasi Thompson said: “This government inherited a rapidly growing economy. Fiscal cliff, what fiscal cliff?” Thompson was addressing Prime Minister Philip Davis’ repeated assertion that his administration has brought the country from the edge of the “fiscal cliff” and revived the economy.

Thompson continued: “Your revenue grew, but you revenue benefited from the end of the FNM tax breaks and tax cuts from the special economic zones and small businesses and revenue also grew because of the high global inflation.”

“They inherited a growing economy. They also benefited from the tax increases from the breadbasket items, the tax placed on breadbasket items and medicine,” said Thompson.

“They also benefitted from the increase in inflation because once that happens all of the Customs duties and VAT are going to increase at the same time. The PLP also don’t want to tell you that they inherited one of the strongest levels of foreign direct investment receipts. We were number one in small island developing states during what as the worst global economic downturn.”

During his contribution to the mid-year budget debate, Davis noted that the government’s revenue performance during the first half of the fiscal year 2022/2023 “has improved significantly due to a vibrant, rebounding economy and strengthened collection efforts.”

“Macroeconomic indicators show persistent demand in the tourism sector with continued growth in visitor activity and occupancy rates in hotels and the home rental market. These factors, and revenue policies and administration strategies, have produced results, with total revenue estimated at $1.3 billion for the first six months of the fiscal year,” said Davis.

He noted that total revenue has surpassed the prior year by $124.6 million and stands at 44.9 percent of the budget forecast.

“Compare that to the first six months of the fiscal year 2018/2019, which can be considered the last “normal” fiscal year, when the total revenue collected during this period accounted for 38.2 percent of the budget forecast. This administration’s policies to restore the country’s fiscal health are working – and they are working alongside policies to invest in our people and in our future,” Davis said.