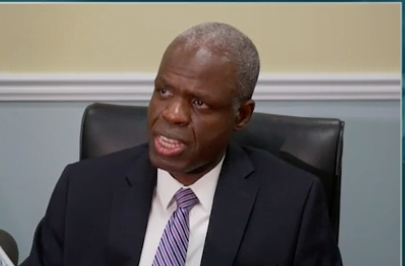

“We would be better off seeing those funds spent on rebuilding”

NASSAU, BAHAMAS — The Central Bank is estimating at least $200 million in Hurricane Dorian-related insurance payouts has still not been used to date.

Central Bank Governor John Rolle, while addressing the regulator’s Monthly Economic and Financial Developments report for June yesterday, expressed the desire to see those insurance proceeds used towards the payments of goods and services in the post-Dorian rebuilding effort.

“There is no intention or desire for those funds to sit and remain unused. We would like to see [the] economy benefit from a faster pace of rebuilding, meaning that those resources get used up,” said Rolle.

According to Rolle, following Hurricane Dorian’s devastation in September 2019, insurance claims payouts were estimated to be well in excess of $500 million.

“Today, from what we have seen, we estimate there is at least $200 million or so in funds that have not been used. We would be better off seeing those funds spent on rebuilding,” said Rolle.

Rolle noted that the country’s external reserves have increased to near $2.6 billion as of mid-July.

“These balances are expected to decrease over the remainder of 2021, but not to any level that would cause concern,” said Rolle.

He added: “In the context of the domestic liquidity, the Central Bank also expects that the foreign reserves are at a level to allow the economy to support more private sector capital raising in Bahamian dollars.

“Taking account of the improved Forex market conditions, the Central Bank has already removed the majority of the conservation measures that were introduced in 2020. The remaining measures relate to capital market investments, principally through the local broker-dealers or securities market firms, and the investment currency market.

“These restrictions are under review for timing that would see them removed before the end of 2021.”