By Derek Smith Jr

As I ran along the Cable Beach strip contemplating why I decided on a vigorous “speed repeat routine” as embarked on my second week of a year-long journey to running my first full marathon, I was stopped by Bahamian-born, now Washington, DC-domiciled, Reuters Business Writer Katanga Johnson. Amidst our thought-provoking conversation on changes within the global regulatory environment, of which he writes extensively, one position stood firm — the compliance function is statistically one of the fastest growing professions and one of the few where growth is expected in 2021, yet many aspiring compliance professionals are seemingly unaware of its complexities and, more importantly, its processes versus speed.

Just as running a race requires a science, compliance, too, requires a skillful and methodical approach. Irrespective of which jurisdiction or industry, there are rules, regulations, guidelines that shape the environment of which an organization must be compliant to, at minimum to avoid unwanted regulatory pressure or fines.

Locally, within the financial services sector, we have experienced a suite of acts, regulations and guidelines that were truly transformative. An example of one such transformation is the Digital Assets and Registered Exchanges (DARE) Act, 2020 that came into effect on December 14, 2020. DARE acknowledges digital ledger technology while simultaneously bringing regulations to the issuance, sale and trade of digital assets in or from within The Bahamas.

Other notable examples were relayed in the August 2018 Central Bank of The Bahamas notice, which stated: “The Proceeds of Crime Act, 2000, Financial Transaction Reporting Act, 2000 and the Anti-Terrorism Act, 2004 have been repealed and replaced with the Proceeds of Crime Act, 2018 (POCA 2018), Financial Transaction Reporting Act, 2018 (FTRA 2018) and Anti-Terrorism Act, 2018 (ATA 2018), respectively. Additionally, the Financial Transactions Reporting Regulations, 2000 and the Financial Transactions Reporting (Wire Transfers) Regulations, 2015 (the wire transfers regulations) were also revoked and replaced with new regulations.”

Based on the quick snapshot above and for good corporate governance, I wish to provide three tips as your organization designs its pathway to being compliant with our jurisdiction.

Evaluate your risk position

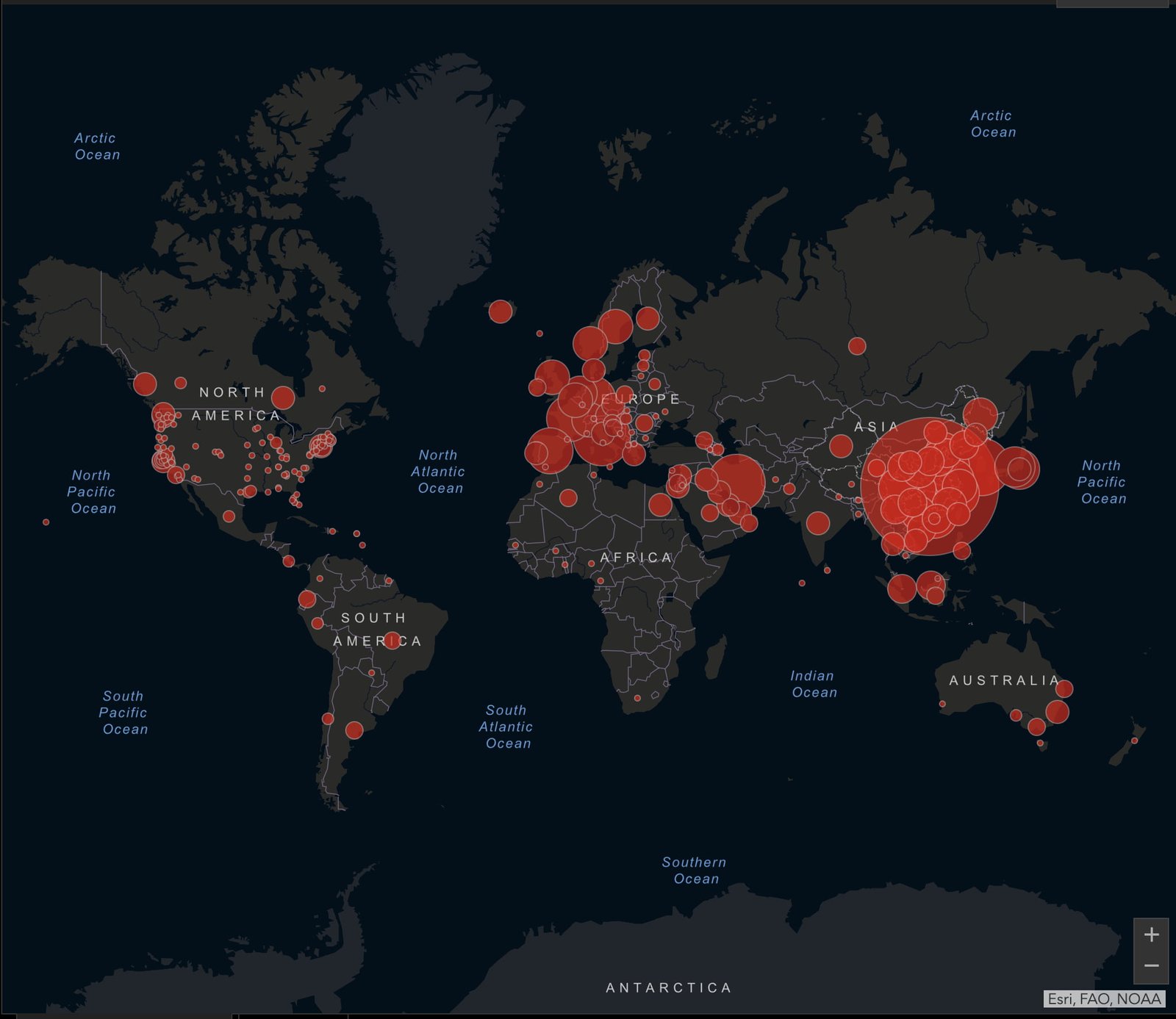

The risk assessment must be your starting point. Based on the size, business channels, vendor complexities, customer geographical spread, services offered and more, this assessment, once designed and implemented, managed and monitored effectively, will give you a sobering reality of your institution’s exposures, its mitigating controls and its residual reality. From that point, an action plan can be designed and must include organizational stakeholders and not only shareholders.

Regulatory gap analysis

In my article entitled “The Fine Art to Reduce Sanctions”, released in July 2020, I explained: “A strong regulatory compliance framework can be the distinguishing factor on whether your institution survives.” Compliance officers must be acutely aware of the policies and procedures of their institution (internal environment) while simultaneously making themselves aware of changes in acts, regulations, directives and standards (external environment). If a gap is identified between the internal environment and the external environment, actions, owners and timelines should be established and properly documented. Costs and human resources must be taken into account before deploying the aforementioned.

Create a compliance plan

The results of your risk assessment and regulatory gap analysis would generate key aspects of the compliance plan. It is important that the compliance plan be agile yet consistent. This would provide your institution with the knowledge and details needed to remain informed of changes, both internally and externally.

Conclusion

In short, compliance is an opportunity for an institution to understand itself on a deeper level, grow and evolve. The pathway to being compliant may be vigorous, filled with evolving pitfalls and occasional costs, but with robust risk and compliance structure, these apparent obstacles can be turned into opportunities that could lead to profits. Institutions must trust the compliance process versus speed to just react. The compliance process is built to be proactive versus reactive.

Derek Smith Jr is a Top 40 Under 40 leader; the compliance officer at Higgs & Johnson, a leading law firm in The Bahamas; and the former assistant vice president, Compliance & Money Laundering Reporting Officer (MLRO), at an international private bank. He is also a CAMS member of the Association of Certified Anti-Money Laundering Specialists (ACAMS) and an executive member of the Bahamas Association of Compliance Officers.