By Luis Alberto Moreno, IDB president

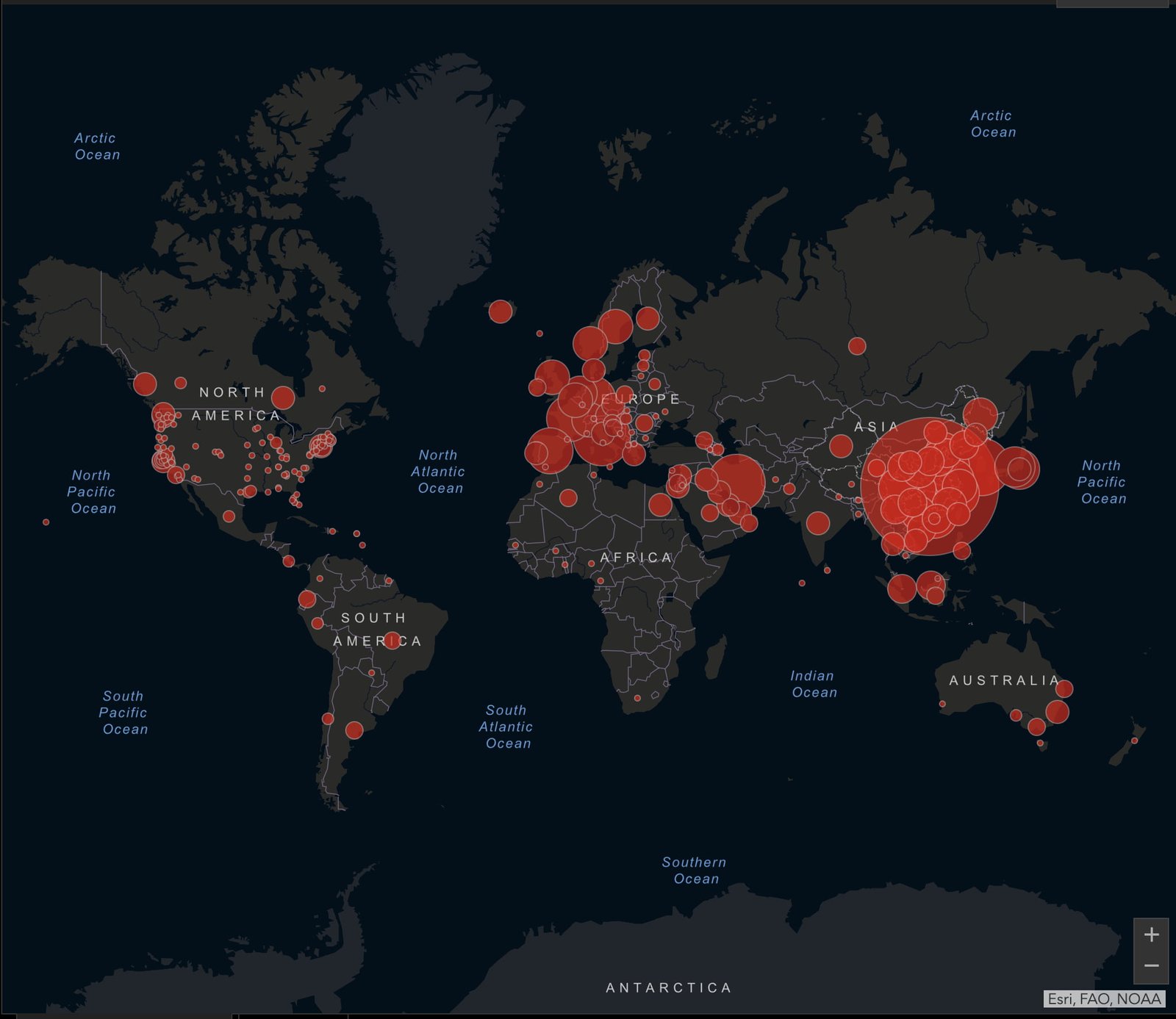

While the protests that are still unfolding in several Latin American and Caribbean countries were triggered by discontent with public services or the price of transportation, they are fundamentally driven by anger over the persistence of inequality.

Disparities between the rich and poor exist nearly everywhere, but they are most pronounced in this region, home to eight of the world’s 20 most unequal countries.

In industrialized countries, taxes and social expenditure have proven to be an effective tool to reduce inequality. In the OECD countries, for example, these policies reduce disposable income inequality by almost 40 percent on average.

In Latin America, by contrast, taxes and social spending only reduce inequality by 5 percent, on average.

This is in part because Latin American governments collect proportionately less tax and spend less on social services than the OECD. But it is also because fiscal policies are much less progressive in this region, and because the quality of public expenditure is still very poor.

On the revenue side, Latin America and the Caribbean collect 23.3 percent of their GDP in taxes, compared to 34.3 percent in the OECD (Argentina and Brazil are notable exceptions, since they collect slightly more than the OECD average).

Since around half of all workers in Latin America do not have formal employment, income tax revenue is low. But even in the top tenth of the income spectrum, average income tax pressure is just 4.8 percent, according to the U.N. Economic Commission for Latin America and the Caribbean.

In the European Union, the top decile pays more than four times as much in income tax (21.3 percent).

For decades, Latin American governments have chosen to rely mostly on consumption taxes, such as the value added tax, as their main source of revenue.

These taxes tend to be regressive, as poor households spend a larger share of their income on consumption—but they are easier to collect. On average VAT and other consumption taxes account for 48.5 percent of public revenue in the region, compared to 32.4 percent in the OECD.

This distortion is compounded by the fact that social spending in Latin American and Caribbean countries also tends to favor the rich.

On average, around 75 percent of cash-based social spending in the region is concentrated on pensions that benefit middle and upper-income families, along with subsidies to services such university education or products such as gasoline that do not primarily benefit low-income households.

Even social programs that are specifically designed to be pro-poor, such as cash transfers that are conditioned on school attendance by children, suffer from “leaks” that enable higher-income families to improperly receive benefits. Overall, around 40% of such benefits end in up in the pockets of the non-poor.

Non-cash social services such as public education and healthcare have done much to improve human welfare in the region. But the outcomes and quality of these services continue to be profoundly unequal.

As measured by standardized tests such as the OECD’s PISA exam, education outcomes in Latin America are near the bottom of the international spectrum. Only those who can afford private schools can expect to do better. And the infant mortality rate is twice as high among the poor versus the rich in the region, to cite just one health indicator.

We can no longer postpone the kinds of reforms that will make fiscal policy more progressive, whether by preventing “leaks” in existing programs or eliminating tax loopholes that principally benefit large firms and non-poor families. Most governments now have digital fiscal and social information systems that make implementing such reforms much more feasible than in years past.

Although vested interests will always oppose such changes, the current crises have created an opening for forging the kind of consensus that can enable bold reforms. Mexico in 2013 used a similar moment to enact a progressive tax reform as part of a broad multi-party agreement.

It increased fiscal revenues by an impressive 3.4 percent of GDP without significantly raising value added taxes. Instead it cut subsidies that benefitted the rich and increased income and dividend taxes.

As a result, 70 percent of the revenue from this reform came from the top 20 percent of the income spectrum.

There is no reason to think that similarly ambitious efforts cannot succeed elsewhere in the region, even if the particular circumstances of each country are different.

From Mexico to Chile, people are clamoring for change.

The IDB has supported fiscal and expenditure reforms in the past that increased revenues while improving the quality of public expenditure, and we stand ready to help governments to do so now.