Editor,

In the same week that the governing PLP administration appeared to launch its general election campaign while Bahamians continue to struggle to make ends meet, the business community was thrown into a state of pandemonium by the unprecedented actions of a special taskforce established by the government.

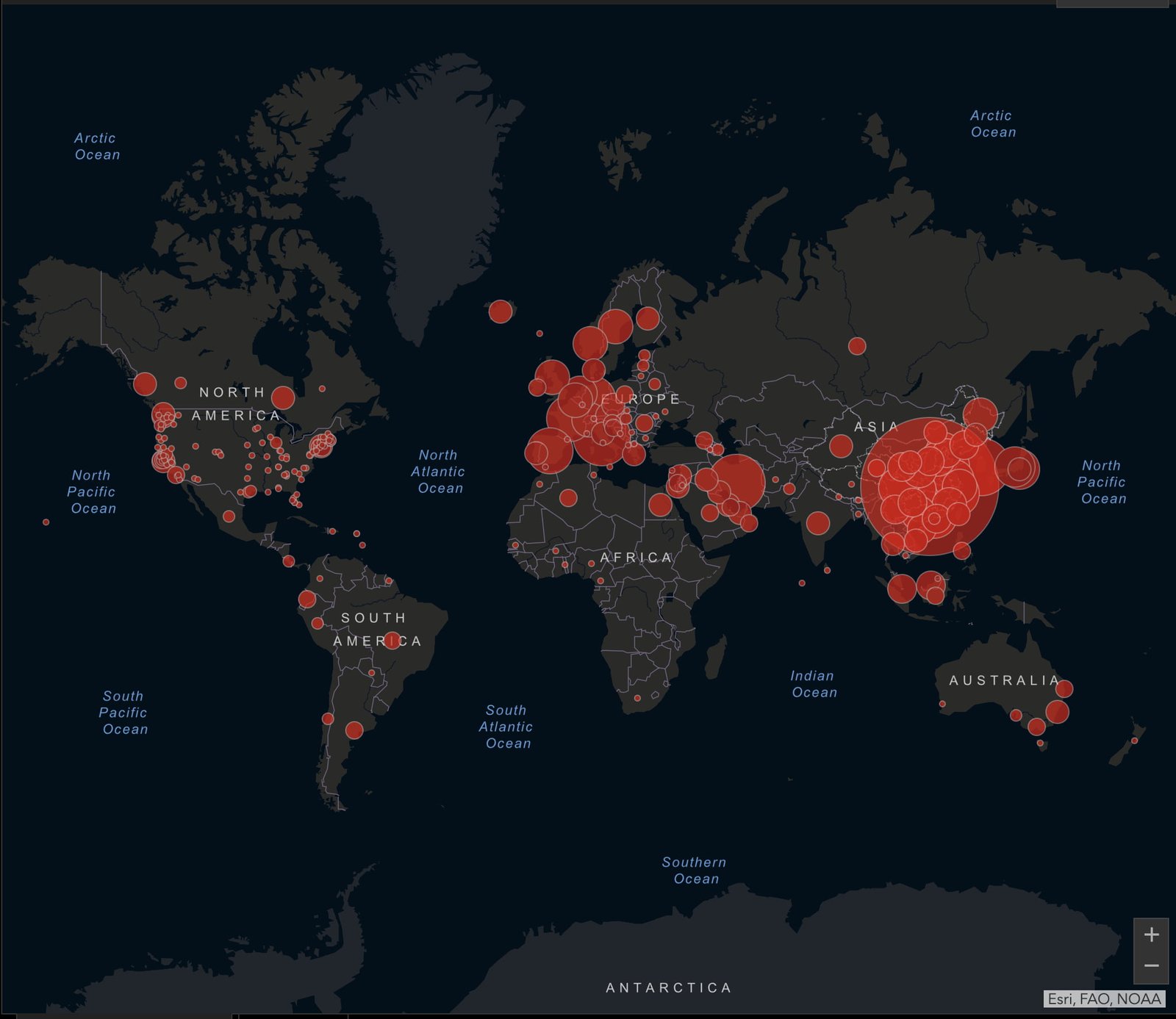

Video footage from the invasion of businesses across New Providence was identical to scenes from crime series and movies. Apparently, operations were conducted via land and waterways, featuring a team from several agencies. While the teams on the mission resembled a SWAT squad, they were, in fact, members of the Maritime Revenue Enhancement Taskforce, consisting of representatives from the departments of inland revenue, immigration and customs, the National Insurance Board, the Royal Bahamas Police Force, and the Royal Bahamas Defense Force.

Sledgehammer approach

It is often said that to every hammer, everything looks like a nail. However, the more appropriate description of the recent approach adopted by the government is the sledgehammer approach. The sledgehammer approach is described as “crudely or ruthlessly forceful; lacking all dexterity or grace.” In this instance, the Taskforce has engaged in using a proverbial sledgehammer to kill ants. The problem with this methodology is that it assumes that the majority and not a small minority of businesses are, in fact, offenders or tax cheats.

Unfortunately, the sledgehammer is unable to differentiate between the good and bad ants. Furthermore, the sledgehammer covers a wide area and radius, inflicting pain on the good innocent ants. The lack of precision and targeting for greater accuracy and effectiveness is one of the main flaws of this approach. It is simply not enough to justify this action on the premise that the good sometimes suffers for the sins of the bad. The impact of this ill-advised action is far-reaching and difficult to quantify at this time.

Desperation and deficit projections

In seeking to rationalize or understand why the government has adopted such draconian and hostile practices, the state of the government’s finances must be considered. The deficit at the mid-year point was $258.7 million – almost double the $131 million projected for the 2023/24 fiscal year. Aggregate spending for the first six months of the fiscal year had increased by $24.7 million to $1.56 billion, with the travel budget increase from $568,000 to $2.2 million attracting much public backlash.

During the 2024/25 budget communication, it was made clear that the government was behind on its revenue projections for the first nine months of the 2023/24 fiscal year. Total revenue at that time was 66 percent of the budget forecast even as government spending had increased by $77 million to $2.4 billion, resulting in a deficit of $214 million with three months left in the fiscal year. While many have questioned the government’s stance that the full-year deficit target will be met, the Ministry of Finance has remained adamant. It seems logical to conclude that the government’s desperation to meet its targets may have fueled the raids as the fiscal year’s end was fast approaching.

Government justification and Business Response

The chairman of the task force explained that the task force was motivated to take this route because only ten percent of businesses in need of compliance responded to a previous voluntary compliance exercise. The recent raids, he asserted, would ensure 100 percent compliance. The commentary from the OPM about a review while justifying the Taskforce’s modus operandi was just as disappointing.

The responses from the business community and general public show that this approach has not been well received. The Bahamas Chamber of Commerce and Employers’ Confederation has expressed concern over what it termed as the “contempt” being shown for the business community. In describing the recent actions of the Taskforce observers have used words such as intimidating, unwarranted, overkill, heavy handed, excessive, gestapo, excessive and disturbing just to mention a few. The general consensus seems to be that it was uncalled for.

The Prime Minister’s intervention in rightfully admitting the errors of the task force’s ways was long overdue, but how did we get here in the first place? Was the Prime Minister as the Minister of Finance, with responsibility for directing tax policies not aware of these planned raids? Where was the oversight and leadership that failed to ensure a sensible approach to tax compliance? Why did matters have to deteriorate to this point before an intervention? Who is running the country and how could these major coordinated raids have happened without the approval of the Minister responsible? The buck stops with the Minister of Finance.

Conclusion

All right-thinking Bahamians understand and agree that individuals and businesses should meet their tax obligations in a timely manner. The question is whether the new approach to enforcement and compliance is the best one. All business people should not be treated like criminals. In 2024, the government’s technology platforms should have enough information and intelligence to track compliance and target those violating the law.

Arinthia S. Komolafe