45 entities identified as credit information providers

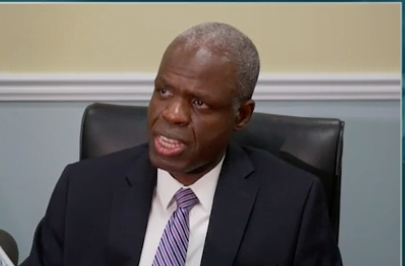

NASSAU, BAHAMAS — The country’s credit bureau operators are making “good progress”, according to Central Bank Governor John Rolle, who recently noted that the entity can soon begin to provide credit report information back to various institutions.

Rolle recently told reporters: “The credit bureau operators are making good regress. They are receiving reports from the banks in the first instance and are working with the other financial sector entities that will be reporting and the utility companies that will be reporting so that they can progress to a regular reporting state.

“For all intents and purposes, the bureau is at the point where it can begin and soon begin to provide credit reports back to the agencies that have submitted data, meaning that they are in a position where they can do analysis on the information and provide analysis to those institutions.”

A credit bureau effectively acts as a central database that lenders can use to obtain a more complete, accurate picture of the risk and creditworthiness presented by a particular borrower. While data collected by this nation’s credit bureau will impact an individual’s creditworthiness and personal credit score, banks — depending on their risk tolerance — will still determine whether not to extend credit.

Sherrece Saunders, deputy manager of the bank supervision department at the Central Bank, while addressing a recent Citadel Consultants fraud prevention seminar, noted that the credit bureau officially went live on April 30.

She noted that 45 entities have been identified as credit information providers.