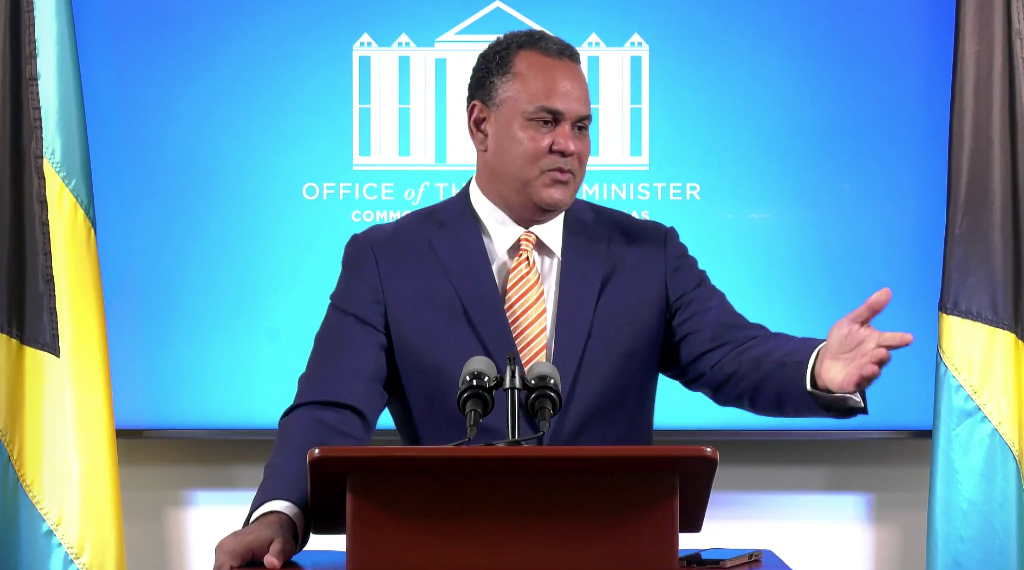

NASSAU, BAHAMAS — Economic Affairs Minister Michael Halkitis yesterday assured that all business license applications will be processed by March 31st, as he urged business owners to “bear with us.”

During a weekly press briefing at the Office of the Prime Minister yesterday Halkitis acknowledged delays in the processing of business licenses due to the Inland Revenue Department requesting additional information. He noted that the department has to verify whether the information being submitted by businesses is accurate.

“I think we have in excess of 33,000 business license applications, of which 3,000 have been successfully dealt with and approved. There is nothing else required of them,” said Halkitis.

Businesses with an annual gross turnover of $100,000 plus are required by law to be Value-Added Tax (VAT) registrants.

“Of all the applications we have just under half, 47 percent reporting zero turnover or the exactly the same turnover for the last three years,” said Halkitis, noting that Inland Revenue officials suspect that there is significant underreporting taking place.

He continued: “We’re not requiring everyone to hire an accountant, provide audited statements or income statements.”

He further added that the government has agreed to fast-track the applications of certain businesses such as taxi drivers, straw vendors, and road side vendors. Further, to assist with the heavy application volume, Halkitis said that some 24 persons have been redeployed to the Inland Revenue Department.

“We agree that we should have more consistent communication with the public and undertake to do that. We are looking to improve our customer service,” said Halkitis. He added, “I would just ask the public to bear with us. This is the renewal period and so there will be some delays. No one will be out of business.”

In terms of the requirement for business owners, particularly those renting commercial space to provide a property tax assessment number, Halkitis explained that the intention is not to create friction between the tenant and landlord.

“We are not asking any business to be concerned with whether their landlord paid property tax or not. If you know the assessment number you can provide it but if you don’t just tell us the name of your landlord and the location of your business,” he said.