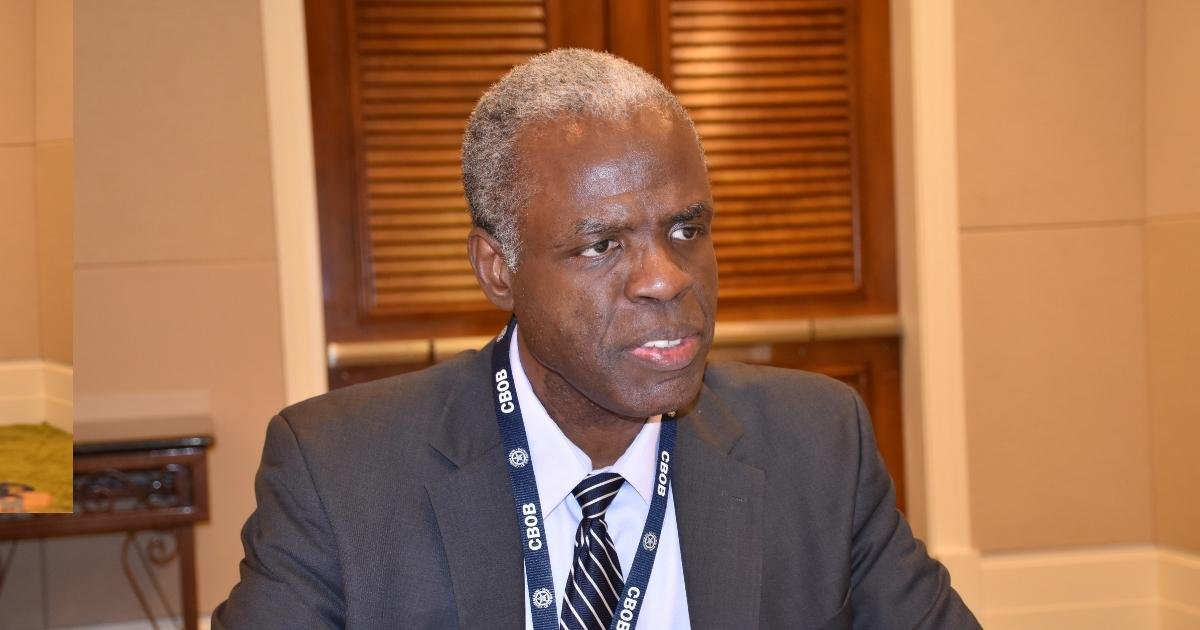

Central Bank governor says Littrell’s comments do not reflect the institution

NASSAU, BAHAMAS — Central Bank Governor John Rolle said yesterday that the regulator is “very sympathetic” to the concerns customers have around banking fees and the quality of financial services in general.

The regulator’s top inspector, Charles Littrell, told attendees of a Bahamas Institute of Chartered Accountants (BICA) seminar this week that he had little sympathy for those complaining about bank fees, suggesting that it is their own fault if they are too lazy to switch to online banking.

Rolle told Eyewitness News, however, that those sentiments do not reflect the position of the Central Bank.

“The Central Bank is very sympathetic to the concerns that users of the banking system have around fees and the quality of financial services in general,” said Rolle.

“The bank has just hired an ombudsman, who has a mandate in the near-term to work with financial institutions to improve the transparency around services provided to the public.

“The ombudsman will also lead the bank’s efforts to develop legislative proposals for the government to strengthen the consumer financial protection system for The Bahamas.

The Central Bank will continue to promote reforms that help to make the process of delivering financial services to the public more efficient.

– John Rolle

“Such proposals will be benchmarked against best international practices and be exposed to broad public consultation.”

Rolle added: “In parallel, the Central Bank will continue to promote reforms that help to make the process of delivering financial services to the public more efficient, and ensuring that more efficient digital services channels are put within the legitimate reach of all residents.

“There are important policy interventions that will be needed to make this possible, as some residents still require access to data services to take full advantage of digital banking; and some, particularly small businesses, still need to be enabled to accept digital payments.

“The Sand Dollar is designed to bridge most of these gaps, and to help to deliver on inclusive digital finance.”