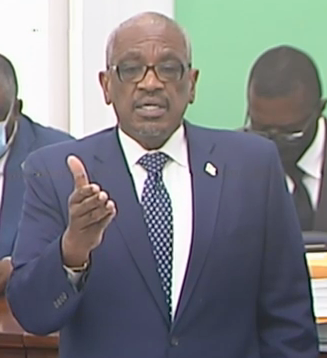

Prime minister urges Bahamians to take advantage of tax forgiveness programme

NASSAU, BAHAMAS — The government is providing Bahamian property owners with up to a 50 percent discount on real property tax arrears, Prime Minister Dr Hubert Minnis revealed yesterday.

Minnis, while leading debate in Parliament on the 2020 Fiscal Strategy Report as well as a compendium of financial and statistical legislation, noted that real property tax collection has long been a challenge for the government.

“There has been some improvement over the years, but there remains a substantial backlog of real property tax arrears spanning many administrations,” said Minnis.

“My government understands the challenges faced by families and business owners, which have been exacerbated by the COVID-19 economic downturn.

“To ease the burden on persons and to provide them with some measure of relief, Cabinet has approved a Real Property Tax Forgiveness programme that will provide substantial discounts on arrears.”

Minnis noted that for Bahamian property owners, the government will waive 50 percent of the total amount unpaid arrears for more than 180 days on such property, including overdue tax and accumulated surcharges, where full payment of all amounts due and payable is made on or before May 31, 2021.

“For those who are unable to pay 50 percent, if they enter into a payment agreement with a 25 percent down payment on or before May 31, 2021, the government will waive the total accumulated surcharge payable on taxes assessed on such property that has remained unpaid for more than 180 days,” the prime minister said.

“I urge Bahamians to contact the Department of Inland Revenue and take full advantage of this tax forgiveness program.”

Minnis also noted that upgrades to the real property tax database to allow for better synchronization between the relevant agencies is nearly complete.

“In 2019, the government engaged the international software and technology firm Tyler Technologies to upgrade and modernize the Real Property Tax Roll at the Department of Inland Revenue (DIR),” he said.

“At the time, it was estimated that some $21 million in revenue was being lost due to incorrect property appraisals and antiquated systems. Although the door-to-door and lot-to-lot assessments were delayed due to the pandemic, we are pleased to announce that upgrades to the Real Property Tax database and systems are soon to be complete.”

Minnis added: “These upgrades will allow for better synchronization between the Real Property Tax unit and DIR and the Registrar General’s Land Registry.

“For the average Bahamian or investor, no longer will you have to wait weeks and pay high fees to investigate the amount of taxes owed on a piece of property you wish to buy or sell.”