“We are going to be focusing on making an aggressive push to get more businesses enrolled in the infrastructure”

NASSAU, BAHAMAS — The Central Bank estimates that in excess of 20,000 individuals are currently utilizing Sand Dollars, with “north of $300,000” of the digital currency currently in circulation.

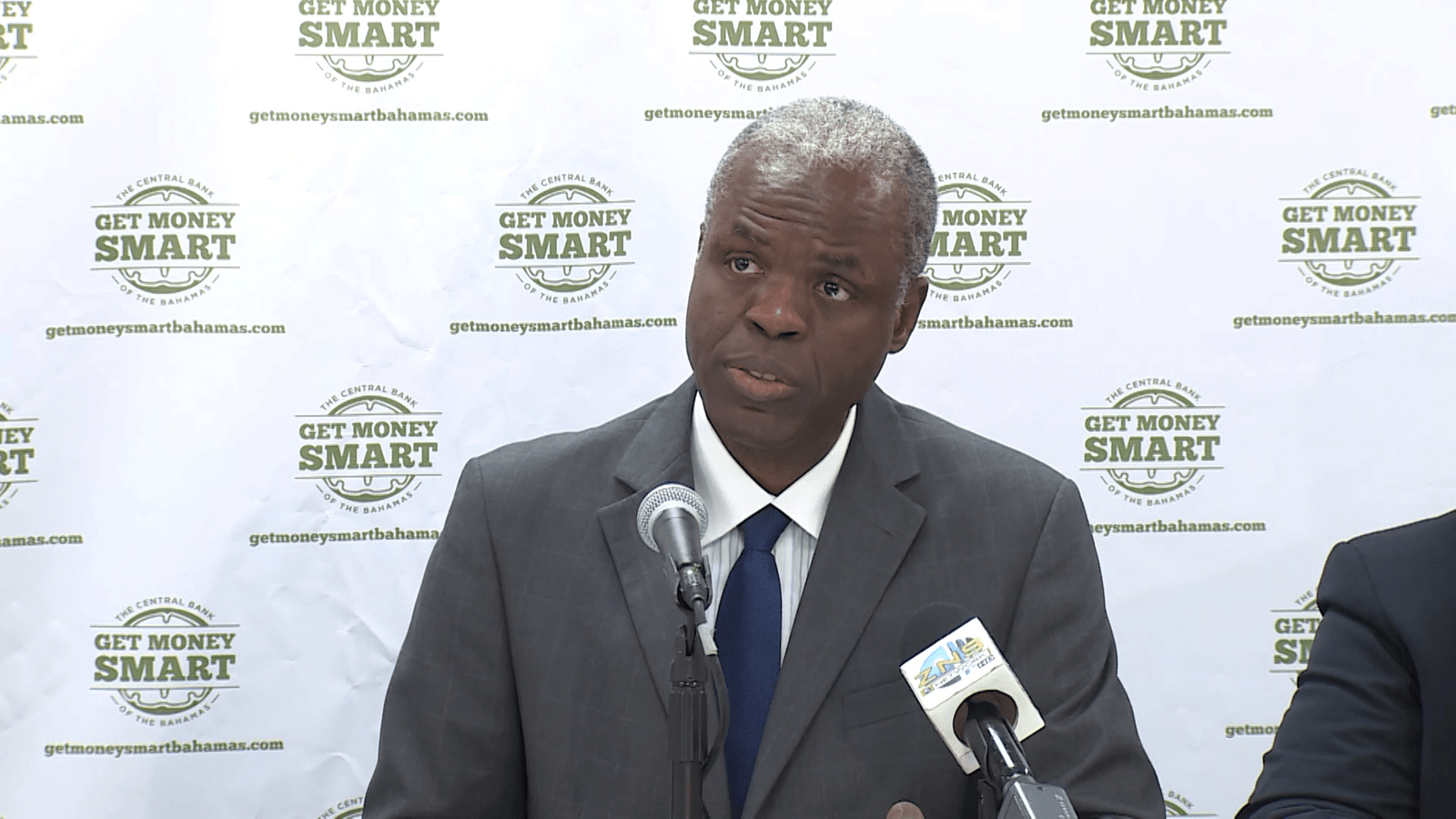

Central Bank Governor John Rolle yesterday noted that great progress has been made regarding Sand Dollar’s rollout.

“In the near term, our priorities have been around completing the connectivity of the infrastructure to the banking system,” he said.

“We are nearing the end of ensuring there is interoperability with the automated clearing house (ACH) so there can be a pass-through link between Sand Dollar wallets and deposit accounts.

“Once that exercise is completed, we, along with the financial institutions, are going to be focusing on making an aggressive push to get more businesses enrolled in the infrastructure.”

Rolle added: “When you add together the population of mobile wallet users who have access to Sand Dollars on the various platforms, we estimate that number is in excess of 20,000 individuals.

“What is important is to expand the merchant base so there is more spending across the platform. It is at that point that we will see more meaningful statistics on the usage of Sand Dollars in circulation.

“We are trying, at this instance, not to emphasize it too much because there is still a low amount in circulation but we are seeing growth in the amount in circulation.”

Rolle explained that there is currently in excess of $300,000 Sand Dollars in circulation.

“I think we are over the $300,000 level. Those numbers are not very meaningful at this stage because what is most important for us is to get there to be more spending across the platform of the wallet sponsors,” he said.

“What we are seeing now are funds that are being exchanged change between platforms and in many cases, these are net settlements going on across platforms.”