Govt bonds and ombudsman also on the agenda

NASSAU, BAHAMAS — Private sector delinquency or non-performing rate on commercial bank loans increased from a pre-pandemic level of eight percent to 9.6 percent at the end of 2021 and could rise further in the immediate months ahead, according to the Central Bank.

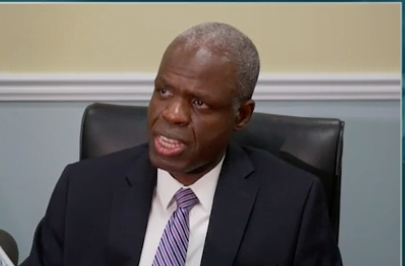

Central Bank Governor John Rolle said yesterday that although this rate could rise further in the immediate months ahead, the regulator believes it will stabilize and begin to decline before the end of 2022.

“As a sign of the improved clarity, at present, virtually all loans that were in deferred payment arrangements at the middle of 2020 have returned to some regular payment status,” said Rolle.

“In 2021, however, credit to the private sector contracted again, reflecting net repayments for mortgages and consumer loans.

“Nevertheless, there was further increase in lending for business and other purposes. Outstanding credit could remain flat to contracted in 2022.

“In particular, lending institutions are still held back by delinquency rates which have to improve to levels even below the average ratios experienced ahead of the pandemic.

“Such an outcome remains dependent upon expanding economic activity and increasing the pool of qualified borrowers for credit as the economy improves.”

Rolle also noted that a government savings bond for small investors is in the works.

“That is a very important initiative for the Central Bank and I would speculate as well for the Ministry of Finance,” said Rolle.

Lending institutions are still held back by delinquency rates which have to improve to levels even below the average ratios experienced ahead of the pandemic.

– Central Bank Governor John Rolle

“We want to place investments in government bonds more within the reach of the small investor and in the individuals who need to do it in incremental steps.

“That’s on our active work agenda for this year in terms of continuing to develop the framework.”

With regards to the financial services ombudsman who will oversee the swift resolution of consumer complaints, Rolle said: “Insofar as the ombudsman is concerned, we recruited an individual for the role towards the end of the third quarter of last year.

“The ombudsman is focused on advancing the framework for consumer financial protection.”

Rolle noted that the ombudsman will look at bank fees as well as improving the customer relationship between banks, credit unions, money transmission businesses and the public, among other issues.

He said the ombudsman will look at the existing regulatory and legal framework and identify necessary reforms the regulator will recommend to the government.