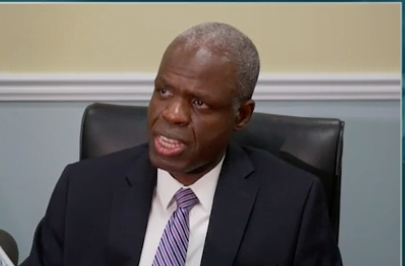

NASSAU, BAHAMAS — Central Bank Governor John Rolle said yesterday he was wrong to believe that Bahamians would have relied heavily on their savings amid the COVID-19 pandemic, noting that this was “nothing to celebrate” as it suggests that many individuals are currently living off social assistance and government support.

“The one thing I’m not happy about being wrong about is the fact that Bahamians have used up less of the reserves by drawing down on their savings as I expected,” said Rolle, who appeared as a guest on the talk-show ‘Z Live’ with host Zhivargo Laing.

“We anticipated in the midst of the pandemic that we would lose some reserves because Bahamians would be coasting off their savings.

“The evidence does not show that that is a significant factor now.

“That is nothing to celebrate because it means that still, it is really social assistance and government support carrying a lot of persons.

“The ideal thing would have been for more of us to have some financial savings to live off.”

Rolle added: “We would have factored that there would have been a few tens of millions of dollars in foreign currency outflows that Bahamians financed by drawing down on their savings.

“That picture hasn’t emerged on the level yet that the Central Bank would have anticipated.

“It means then that the vulnerability or lack of resilience in your population is unfortunately concentrated a lot among the same individuals who have been displaced by the pandemic.”

Addressing the topic of dollarization — replacing this nation’s currency with that of the US — Rolle noted he does not believe that could be a reality in five years.

The Central Bank Governor noted, however, that there should be more discussion on the issue.

“We should be having more discussions and I think we can say do you want to dollarize or liberalize, and not dollarize,” he said.

“I think that helps bring things into focus because the way dollarization is presented today it dismisses all of the other worries and you can’t just put it on autopilot and leave it. That is not true.”

Rolle continued: “The fallacy that is perpetuated out there is that somehow, if you remove all the barriers, that you can borrow in the United States at the same rate as a guy in the United States is borrowing.

“The way I would turn that around is to ask why is the government borrowing in US dollars at a rate of five percent when the interest rate on US government debt is less than three percent.

“The government of The Bahamas does not borrow in the US at the same rate as the government of the United States.

“Why does a business in the Bahamas believe that it can borrow in the United States at the same rates as a business in the US.

“That only happens if you’re not in the same line of business, both face the same political risk, country risk and all the other risks that investors consider.”

He added: “You do not face the same country risk.

“Businesses need to understand that the cost of accessing foreign currency financing even when it is available is not going to be at the same rate that the entity in America accessing those same resources can get.”

Rolle also noted that the country is in a “holding pattern” in so far as managing the use of the foreign reserves.

He added that coming out of this crisis, The Bahamas should be thinking of growing the reserves by more than a billion dollars.