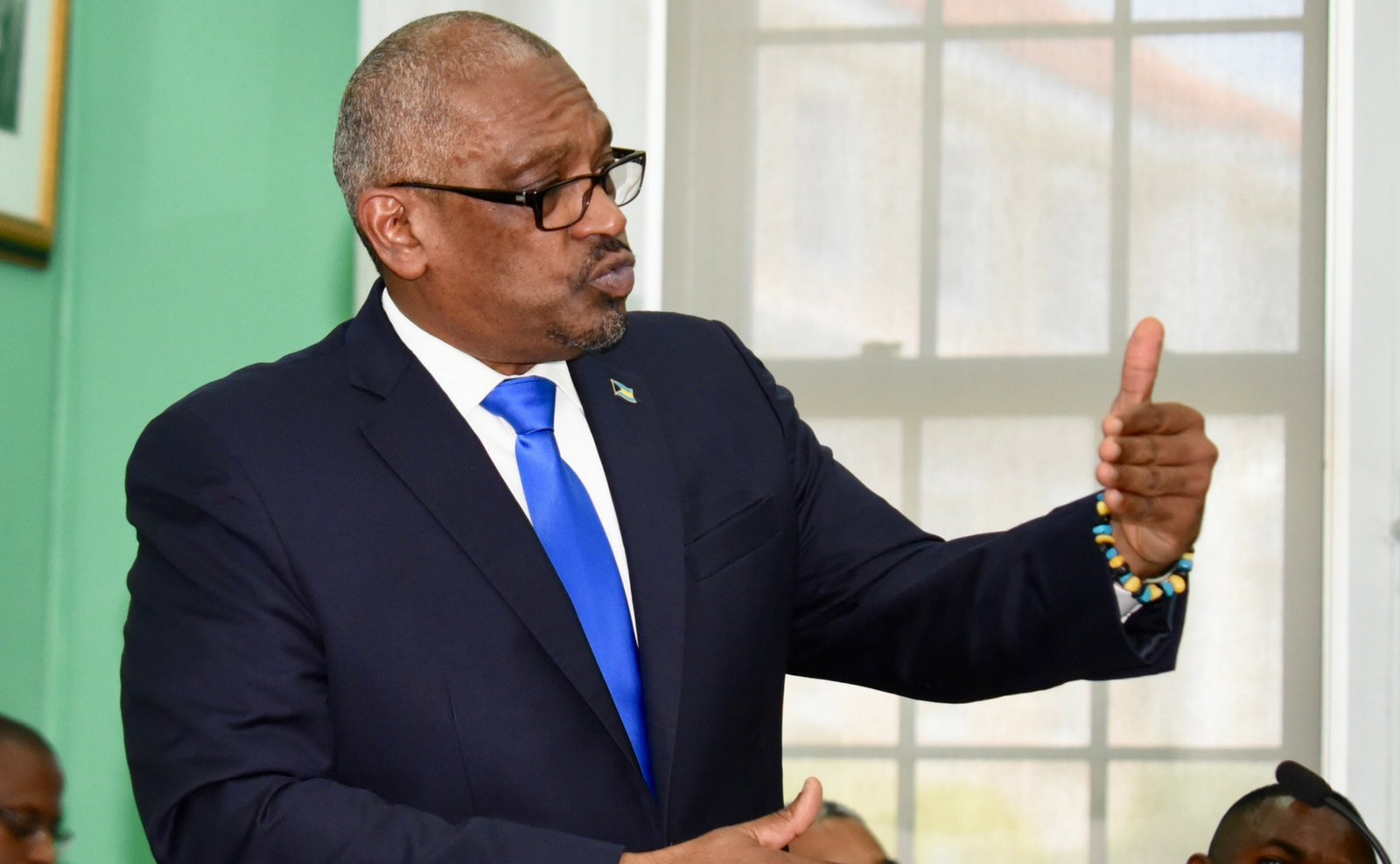

Defending the financial provisions within his government’s proposed 2018/19 National Budget, Prime Minister Dr. Hubert Minnis said the fiscal measures are to ensure a sound economy for future generations.

In his wrap up of the budget debate in the House of Assembly (HOA) on Monday morning, the prime minister also defended the value-added tax (VAT) increase, from 7.5 per cent to 12 per cent, as was previously announced by Minister of Finance Peter Turnquest.

“When we tallied up all of the fiscal pressures that are present, we determined that we faced a fiscal gap of some $400 million if we were to achieve the mandated target of a deficit of 1.8 per cent of GDP in 2018/19,” Dr. Minnis said.

He further explained that as such a target is a “critical part” of his government’s plan to restore and bolster credibility, confidence and stronger growth; it simply has to be met.

“The hard reality is that there are very few feasible options available, within the timeframe required, to fully address a fiscal gap of that magnitude,” he said.

According to the prime minister, the government considered raising VAT from 7.5 per cent to 10 percent, but determined that was not enough to deal with fiscal pressures it encountered. The government, he said, considered raising VAT to 15 per cent but determined that would have inflicted “too much hardship” on Bahamians, so it settled on 12 per cent, which it determined is necessary to save future generations of Bahamians.

“We, therefore, came to the realization that an increase in the rate of VAT to 12 per cent was the only viable and reliable option to allow us to deal with all of the fiscal pressures, while also respecting the requirements of the Fiscal Responsibility law,” he added.

A significant portion of the new VAT revenues will be redirected back into the economy through the payments of arrears to various creditors, among other things.

“We should not lose sight of the fact that the government has been mindful, in the development of its plan to provide tax relief to the most vulnerable in our society,” he said.

He noted that amongst those measures are the elimination of VAT on breadbasket items, medicines, residential property insurance, as well as on electricity and water for a large number of households.

“This budget provides hope and opportunity for new homeowners, entrepreneurs, young people, Over-the-Hill communities, and hope and opportunity for our future,” he said.

“The inspiration for my government and for this budget is to leave behind a better, more secure, safer and prosperous country. Our vision and mission is to provide opportunity and hope for current and future generations. Our vision is taking shape.”

__

This article was written by LINDSAY THOMPSON, Bahamas Information Services.