As many as 60 per cent of the coins produced over the years lost permanently

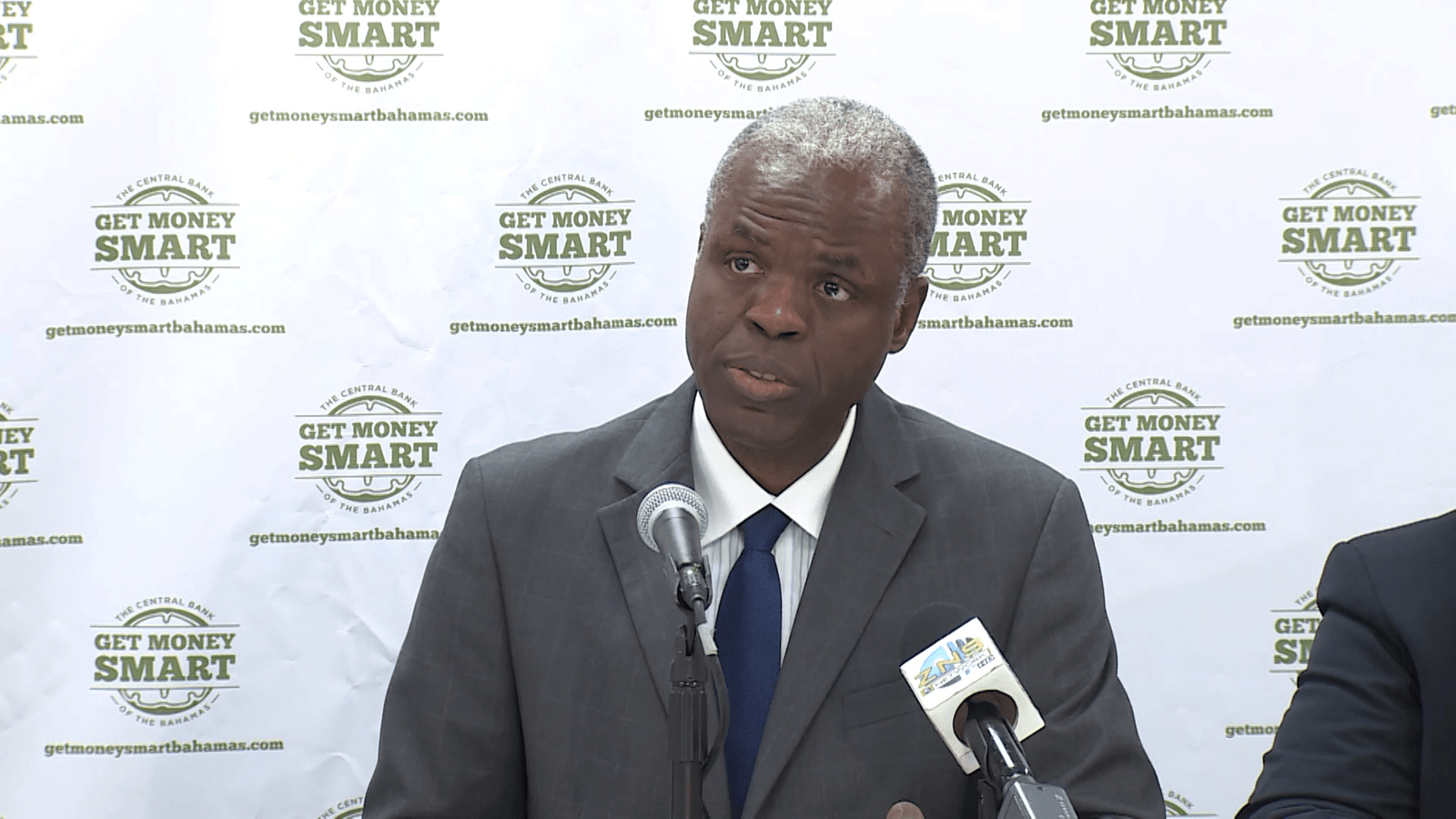

NASSAU, BAHAMAS – The elimination of the Bahamian one cent coin is not expected to have any ‘noticeable’ impact on consumer prices, according to Central Bank Governor John Rolle.

He spoke at a press conference yesterday to launch the kick-off of the regulator’s campaign to decommission the Bahamian once cent coin.

Rolle said: “There will not be any noticeable price impact because most of us experience cash register based rounding already and we know that the practice is not one businesses resist or complain about and is not one we expect the public would be complaining about on any noticeable scale.”

He continued: “The experience today is that businesses are already rounding but in most cases that rounding is universally in favor for the customer.”

The rounding rules proposed by the regulator state the amount of change to be paid will be rounded to the nearest five or ten cents where a total bill is being paid in cash and the number of cents to be paid does not end in zero or five, thus requiring either the customer to use one cent coins in payment or the retailer to use such coins in giving change.

Mr. Rolle said: “There will be a focus on educating the public on how to do the rounding. The bank is working very closely with all the stakeholders around this process.

“There is also likely to be some involvement with the government agency responsible for consumer affairs as to whether it will be necessary on any level for price control regulations around the rounding rules.

“That’s is not to say that we anticipate on any level that moving the penny from circulation will result in higher prices. That is not the expectation. That is not the experience elsewhere.”

Rolle said the move by the bank to eliminate the penny was not an effort to push Bahamians toward electronic banking, saying that the move would be ‘sensible’ even if The Bahamas remained a very high cash economy.

“It’s just the practicality of having that low value coin doesn’t provide much justification for continuing to use it,” he said.

According to Mr Rolle, the Central bank has already ceased production of new one cent coins.

“As of January 2020 we are going to stop issuing coins from our existing holdings to the banks and as of that date the bank will begin withdrawing the coins from circulation,” he said.

“There is a legal step involved where we have to decommission the one cent as legal tender which means there would be some order published in the official gazette.”

Mr. Rolle added: “After the end of 2020 the coins would be no longer be legally accepted as currency but there would be a further six-month period up until June 30th 2021 where the public if they are still holding on to the coins can still turn them in for full value.”

Rolle said that coin sorting machines will be placed in public areas and grocery stores to all persons to turn in their one cent coins.

These machines he explained will issue a coupon for the full value of the deposit. Those receipts he said can be taken to a financial institution for credit or persons can offer them as charitable donations.

Mr. Rolle reiterated that it is not economically or financially viable to continue the production of the one cent coin.

The bank has calculated its costs for withdrawing and repaying the value of the one cent coin at BSD $2–$3 million.