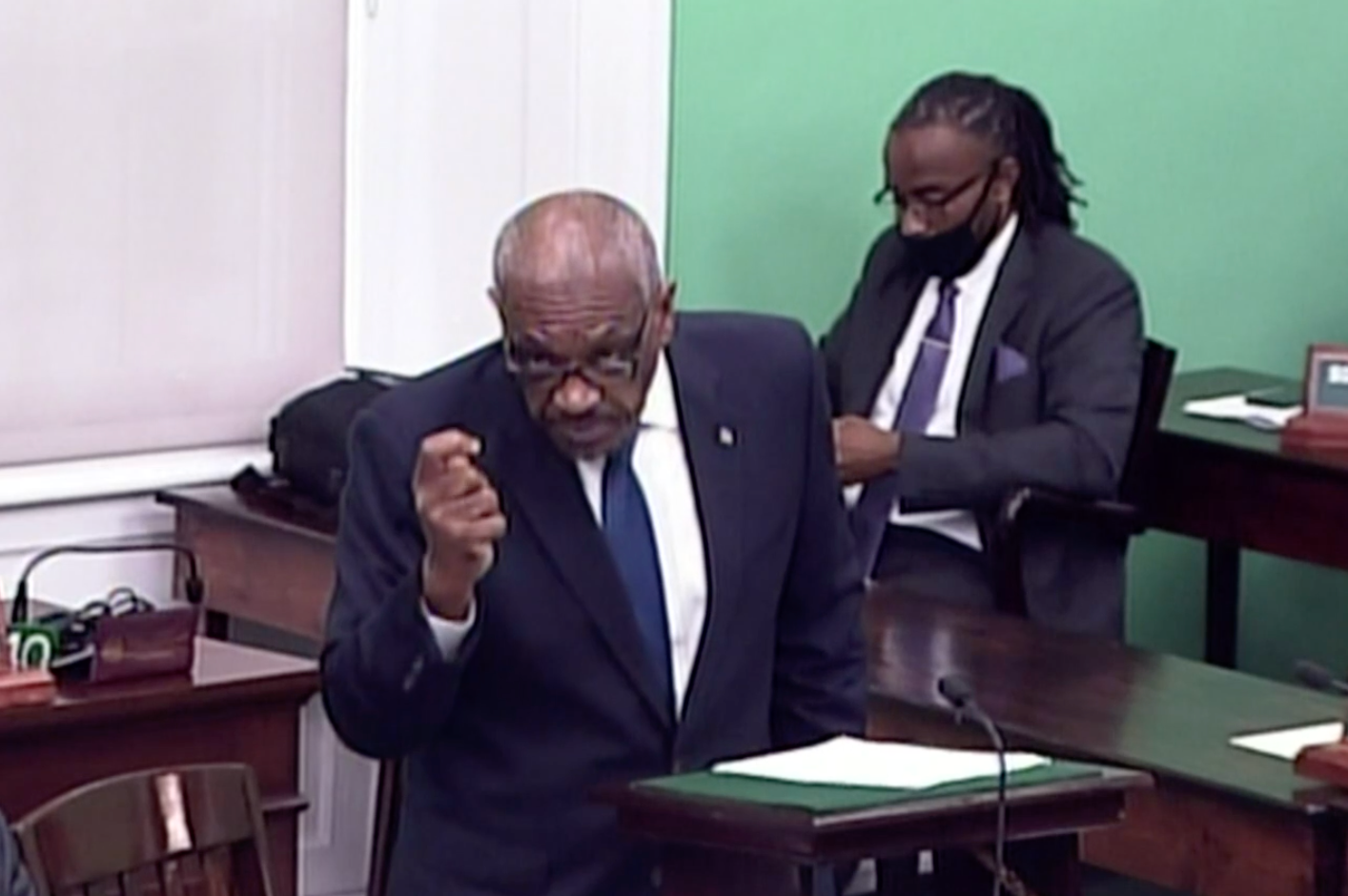

NASSAU, BAHAMAS — Former Prime Minister Dr Hubert Minnis yesterday called on the Davis administration to remove value-added tax (VAT) on breadbasket items as Bahamians suffer from the high cost of food and living.

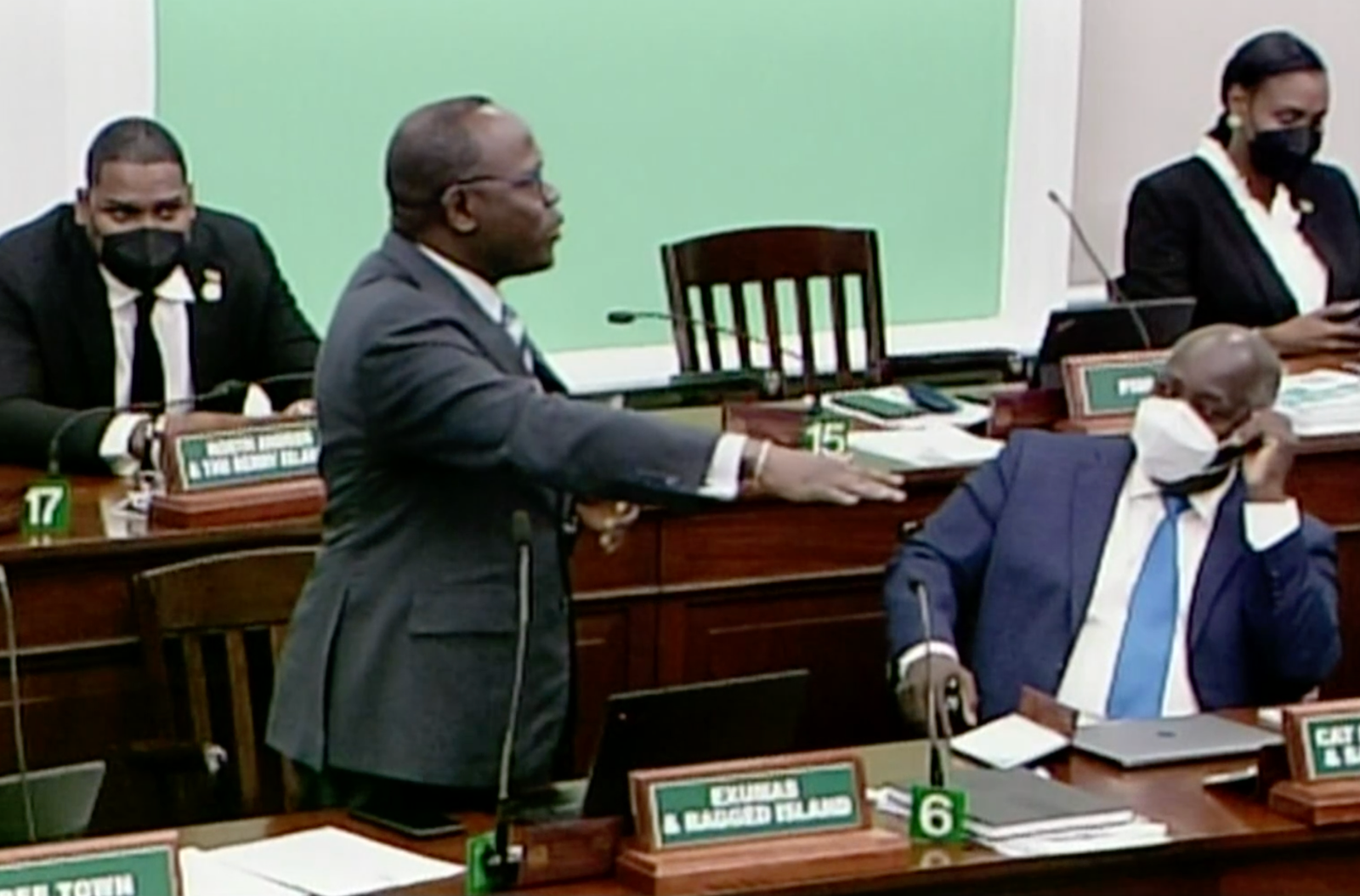

But Deputy Prime Minister Chester Cooper labeled the “tirade” hypocritical.

“I call on the new administration to remove VAT from breadbasket items. Have a heart, man,” Minnis said in Parliament.

“Reverse the bad policy that is causing some food prices to be so expensive.

“They should apologize to the people and reverse the disastrous policy of taxing breadbasket items and this government must realize that many Bahamians are recovering from the devastating effects of the pandemic on our economy.

“It will take a long time before many of our citizens get back to financial positions pre-COVID.

“This was the wrong time to stress poor and working-class Bahamians with more taxes.”

Cooper said Minnis, as a former finance minister, should know that inflation in The Bahamas is driven by what occurs abroad and the recent increases have been linked to supply chain issues.

He said it was disingenuous for Minnis to suggest otherwise.

This is the height of hypocrisy.

– Deputy Prime Minister Chester Cooper

Recalling the VAT increase under the former administration, Cooper said: “This is the height of hypocrisy, Madame Speaker, and to see [him] standing here trying to pretend that the people he ignored, the people who did not believe him when he said he would look after them in his next five years, he now wants them to hear him, Madame Speaker.

“This is misleading and it is hypocritical and it must stop.”

Government members cried “shame” from their seats.

VAT, which was reduced from 12 percent to 10 percent last month, became applicable to breadbasket items, which were previously exempted, along with medicines.

Breadbasket items include foods such as bread, grits, rice, cheese, corned beef, butter, cooking oil, evaporated milk, margarine, mayonnaise, flour, tomato paste, baby cereal, soups, broths, canned fish and baby food and formulae, among others.

The Minnis administration increased VAT from 7.5 percent to 12 percent, claiming the debt and expenditure commitments left by the Christie administration necessitated the increase.

In recent months, the owners of major grocery store franchises have warned of price increases due to global supply chain challenges, as well as global inflation.

Successive Bahamian governments ensured that [breadbasket] items were tax-free because such items are staples used by poorer Bahamians.

– Former Prime Minister Dr Hubert Minnis

Minnis said: “It was shocking to many that, upon coming to office, one of the first things this new administration did was to raise taxes on breadbasket items and at the same time reduce taxes on caviar and champagne.

“Successive Bahamian governments ensured that [breadbasket] items were tax-free because such items are staples used by poorer Bahamians.

“Breadbasket items are also staples used by middle-class Bahamians.”

He said the decision to introduce the tax on this category of foods was a “betrayal of the poor” and an “attack on the poor”.

Minnis said the increase represents a “double whammy” for the poor and some cannot afford to feed their families.