Initiative aimed at protecting up to 10,000 private sector jobs.

NASSAU, BAHAMAS — The government in an effort to protect up to 10,000 jobs within the private sector today announced a payroll support initiative for qualifying businesses, as it will forego some $60 million in revenue over the next three months.

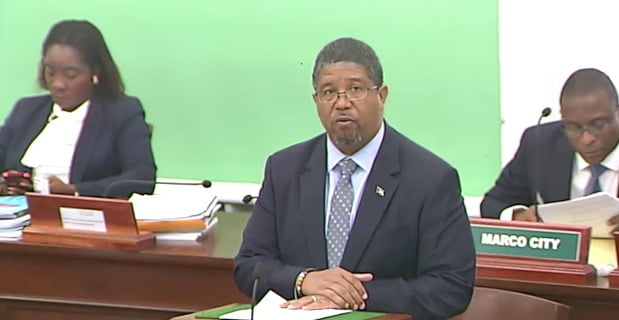

Making the announcement in Parliament today, Deputy Prime Minister and Minister of Finance K Peter Turnquest noted that under the program qualifying businesses can receive assistance under a tax credit and tax deferral to help cover payroll expenses.

“The programme allows businesses to defer the payment of certain taxes and to benefit from a tax credit, up to $300,000 in each instance,” he said.

“This accommodation is specifically to provide businesses with the cash flow to preserve current employment levels. Businesses will have to commit to utilization of the tax credit solely for the purpose of covering payroll requirements,” said Turnquest.

He added: “A qualifying business will make an application to the Ministry of Finance and will be able to withhold their outstanding business license or VAT receipts collected – up to $200,000 per month for up to three months.

“If they qualify at the maximum funding level, then one half of that monthly sum – or $100,000 – will be in the form of a non-reimbursable tax credit. The other $100,000 will be deferred until January 2021 when it will be paid back in equal monthly installments over 12 months.”

According to Turnquest, in order to qualify, a business must have a minimum of 25 employees.

“The qualifying amount for a participating business cannot exceed its non-executive payroll for the relevant period. Companies must commit to retaining 80 percent of their staff count as at February 2020. The net effect of this initiative is that for some businesses, the Government will be paying the salaries of half of their employees for the next three months and providing them with the cash flow to pay the remainder.”

Turnquest said: “Naturally, for a business to be eligible for this programme, it must be in good standing with the government agencies responsible for the collection of taxes and fees. There will be certain business sectors that will not be eligible for the programme, such as retail or wholesale grocery, hotel and resorts, regulated financial and insurance entities, regulated telecommunications businesses and gaming businesses. ”

He noted that the government is budgeting some $60 million in revenue foregone over the next three months to facilitate this initiative – of which $30 million will be effectively provided by the government to pay the full salaries of Bahamians over the period.

“The Ministry of Finance anticipates that some 200 medium and large sized entities will take advantage of this initiative that will support the retention of some 10,000 jobs over the next three months.

Turnquest noted that for businesses that make less than $3 million annually, the Small Business Development Centre (SBDC) is currently providing support through a Business Continuity Loan Programme. “As an additional measure, specifically targeted towards payroll assistance, the Government is offering a grant of between $2,000 to $20,000 for MSME’s who qualify for a Business Continuity Loan to assist with payroll. We are allocating an additional $5 million to finance this initiative,” said Mr Turnquest.