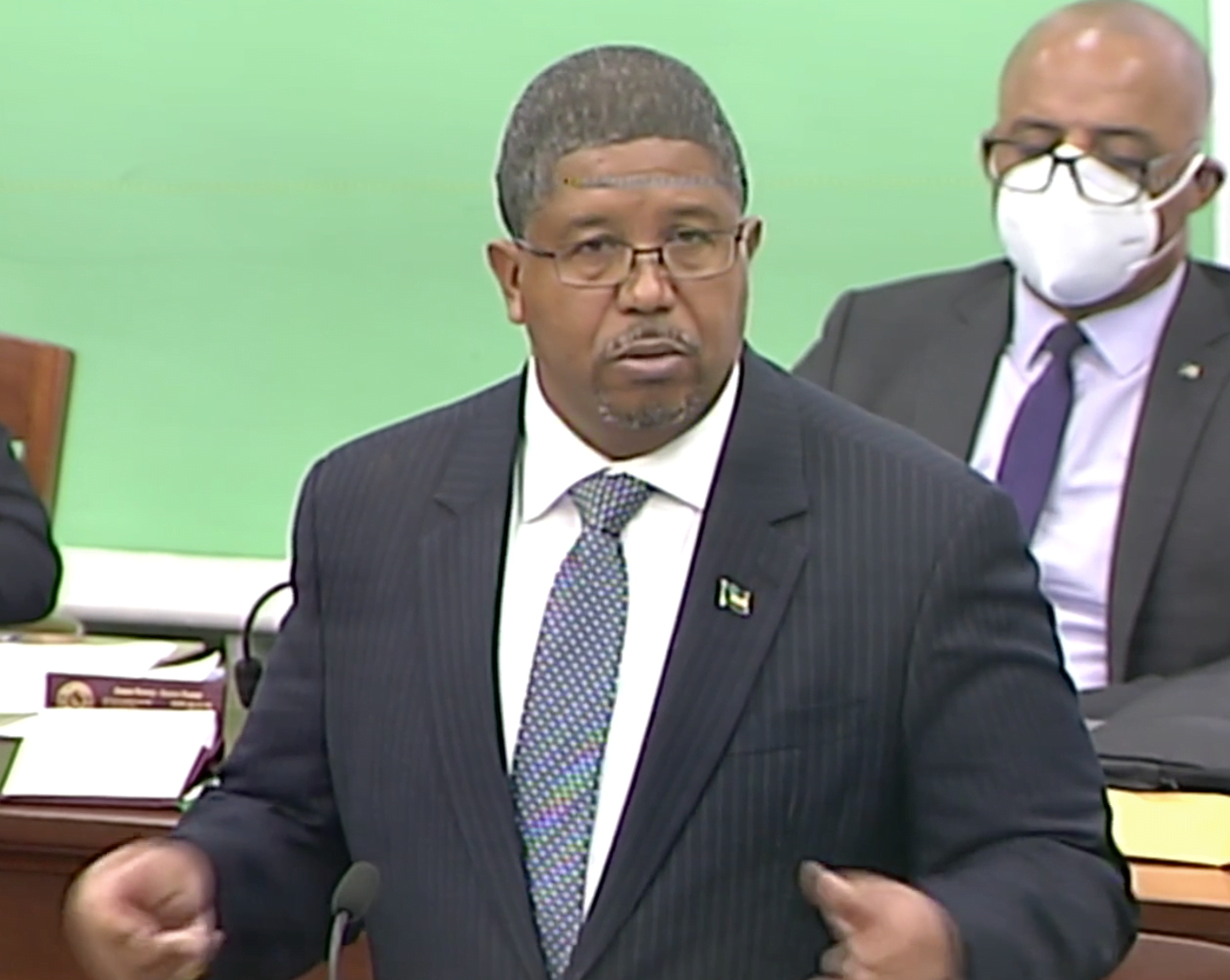

NASSAU, BAHAMAS — The listing of $3.6 billion in government bonds on the Bahamas International Stock Exchange (BISX) will improve the country’s financial market infrastructure and increase accessibility to Government-backed investments for all Bahamians, according to Deputy Prime Minister and Minister of Finance K Peter Turnquest.

Turnquest said yesterday that the long awaited move was contemplated from the establishment of BISX, noting that with the addition of 220 government securities, the number of investment offerings on the national stock exchange have more than tripled.

He noted that The Bahamas is now one of the first Caribbean nations to trade its public debt via its national stock exchange.

The total face value of the 220 BRS instruments is $3.6 billion, with maturities ranging from 1 year to 30 years.

“This long-awaited move was contemplated from the establishment of BISX,” Turnquest said.

“It will improve the country’s financial market infrastructure and increase accessibility to Government-backed investments for all Bahamians. It falls in line with the Government’s strategy to accelerate critical reforms, with an emphasis on modernization and digital transformation.”

He continued: “This is another milestone in the evolution of the Bahamian capital markets. It makes good on a key component of our overall initiative to strengthen the public debt management framework and promote the development of the Government bond market.

“In the long term, it will help to reduce the Government’s overall funding costs associated with the issuance of these securities. Investors will also benefit from the greater ease of purchasing and transacting these instruments and this will have the effect of allowing more and more Bahamians to undertake and benefit from these very stable investment instruments.”

According to Turnquest, the move to BIX will help the Government to obtain more efficient, market determined pricing of its securities, which will be a key input into the pricing of other private and public sector market issuances.

Central Bank Governor John Rolle noted that the inauguration of the integrated infrastructure for the listing and trading of Government debt on The the Bahamas International Securities Exchange (BISX) provides for improved transparency and efficiency in both public and private sector debt market operations.

Rolle said: “It offers a more enabling environment in which mature private firms can raise financing; and it further empowers the Central Bank to perfect indirect monetary policy tools, to influence changes in interest rates in the economy. This infrastructure will draw investors more conveniently into the secondary trading process, as counter-parties to both sides of the buying and selling of government securities. This will increase the transparency around the determination of market prices.”

He noted that up to this point, the Central Bank was commonly the second participant, and therefore, the facilitator of most secondary trades.

Rolle said: “The Central Bank, as Issuing Agent, will continue to facilitate primary market offerings of government bonds and participate, when necessary, to support secondary market liquidity.

“Nevertheless, the average investor’s ability to participate in the market will not be impeded. Government bonds will remain accessible to every Bahamian who wishes to invest, either through a licensed broker-dealer or directly through the market desk at the Central Bank. The minimum investment in any government Bond is still $100.”

BISX CEO Keith Davies said: “We look forward to working with the government on a number of other initiatives because once you have government securities listed on regulated exchange you are then able to expand that to the wider community and benchmarks are able to be created.

“I expect to see our government debt market expand our private debt market and all sorts of other securities will be able to be born as a result of this step we took.”