No more VAT-free breadbasket items

Pension increases, 5G readiness, sovereign wealth fund and national wealth fund among other items on govt’s agenda

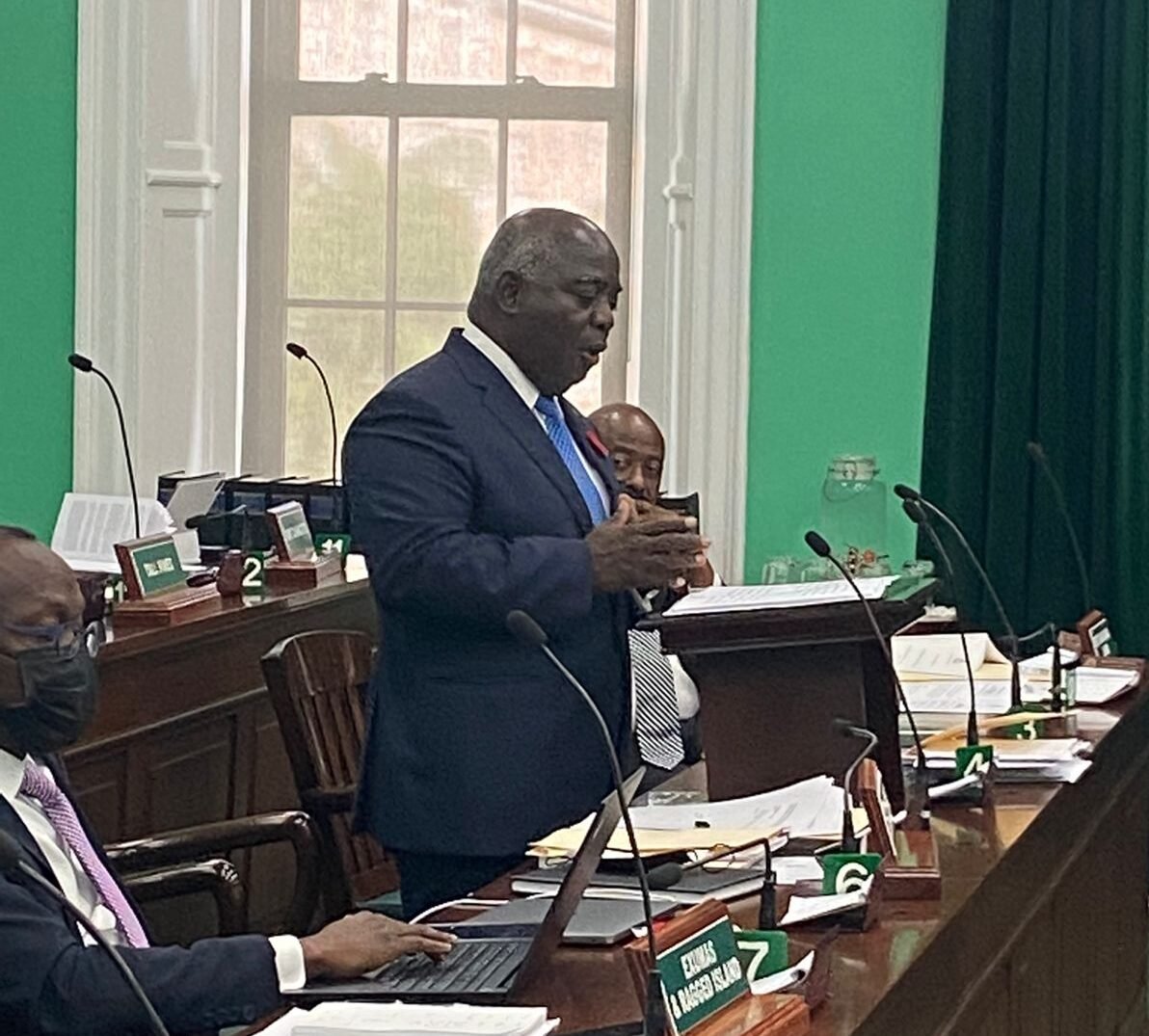

NASSAU, BAHAMAS — The government is moving forward with its promise to reduce the value-added tax (VAT) rate from 12 percent to 10 percent, Prime Minister Philip Brave Davis announced today in Parliament.

He noted that the reduction is being managed in a way that is fiscally responsible.

The prime minister said with the reduction in the VAT rate, the government is eliminating the zero-rating under VAT on a variety of items.

He said price controls are in place to ensure breadbasket items will be fairly priced; and VAT exemption for electricity bills and the special economic zones will be untouched.

The prime minister noted that when VAT was first introduced under the Christie administration in January 2015, it was designed as a broad-based tax similar to the New Zealand model, with relatively few exemptions.

“Through the actions of the previous administration, the VAT base has been eroded by the implementation of many classes and types of items being zero-rated,” said Davis.

“These changes were considered by experts to be ill-advised and poorly executed, who believe zero-rating schemes are an ineffective and inefficient way to provide relief to the vulnerable in society.

“Based on the modeling and analysis conducted by my team, we are confident that with the elimination of zero-rating categories, and the economic uplift to consumers, government revenues are protected.

“The model and the analysis of the results will be published on the government’s budget website.”

The prime minister also announced that:

- Individuals currently receiving $100 per week from the government’s COVID-19 unemployment assistance plan will receive a $500 lump sum payment this Christmas.

- The government will increase public service pension payments, effective December 1, 2021. The 742 people receiving less than $500 per month in pension will receive a monthly increase of $100; the 2,012 people receiving more than $500 but less than $1,000 in monthly pension will receive a monthly increase of $75; and the 4,432 people receiving a monthly pension of greater than $1,000 will receive a monthly increase of $50.

- Increments paid to rank-and-file public officers will also be reinstated this fiscal year. The effective date for the increment reinstatement is July 2021 and the payment date is January 2022. This reinstatement will cost $8 million this year.

- The government plans to achieve a revenue-to-GDP target ratio of 25 percent by the end of its first term.

- The Ministry of Finance is reconstituting the government’s Revenue Policy Committee.

- James Smith, the former Minister of State for Finance, will head a Private Sector Debt Advisory Committee to advise the Ministry of Finance on the nation’s debt strategy.

- The government will create a sovereign wealth fund to monetize the concessionary access to Crown land and seabed leases already provided to foreign investors.

- The government plans to create a national wealth fund to hold the government’s equity in various commercial enterprises. The government said the book value of the government’s various equity investments exceeds $1 billion but the annual return is currently less than one percent, which “is clearly not acceptable”.

- The government plans to make The Bahamas 5G-ready through the establishment of a national fiber network. The government’s support is necessary to achieve 5G connectivity in the medium-term.

- The government will increase the proportion of government expenditure allocated to small and medium businesses by amending the Procurement Act to protect local businesses against unfair competition.