NASSAU, BAHAMAS — A local digital payments provider said yesterday that it is “well on its way” to doubling the $100 million in transactions it hit last Fall, noting that there has been a significant uptick in transactions on its platform.

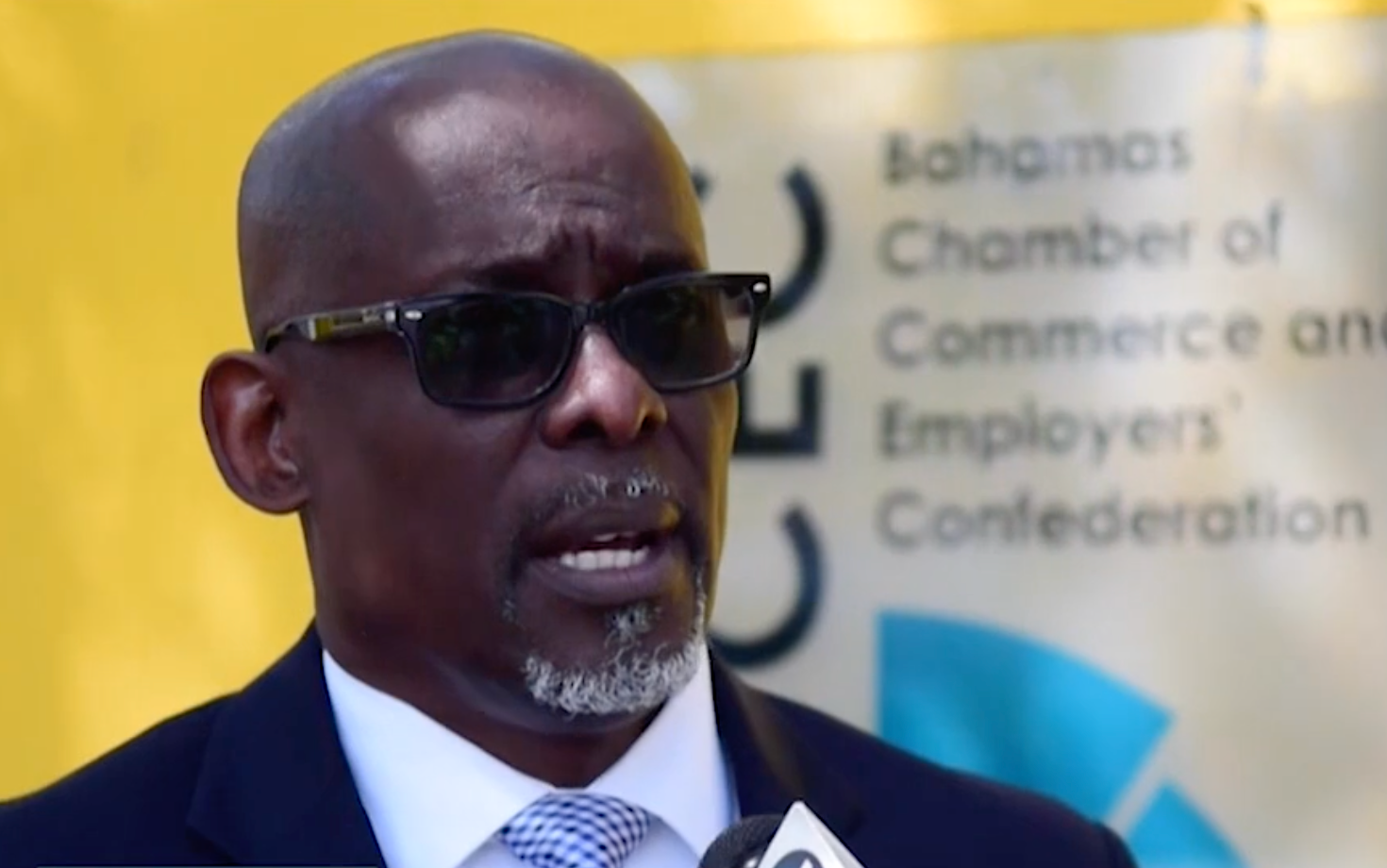

Jeffrey Beckles, Island Pay’s managing director told Eyewitness News that there has been a “consistent” upward trend in the usage of its offerings, especially pre-paid MasterCards and Sand Dollar purchases.

“We are seeing an increase. I think it is due to the fact that more people are beginning to realize the convenience of it, ease of access and their ability to better manage their personal funds,” he said.

“It’s really a better way to carry out transactions and the world is moving away from cash towards more digital payments.

“Late last year, we had indicated that we had done $100 million in transactions and I would say that we are well on our way to doubling that.”

According to Beckles, some 40,000 Bahamians currently use the company’s services.

“Bahamians are beginning to understand the benefits,” Beckles said.

“More and more Bahamians are calling us in reference to the post-Dorian experience and the challenge of not having any banks or access to cash.

“With a digital wallet, even in such circumstances, you are still able to conduct transactions.”

Beckles stressed that digitization and the roll-out of electronic financial services is critical to this nation’s economic growth and COVID-19 rebound.

He also noted that digital payment solutions can also be a tremendous benefit to Family Island communities and businesses on those islands where commercials banks have opted to pull out.

“I certainly think that there is a tremendous opportunity in the Family Islands.

“When we talk about a rebound and all that is happening in tourism, we cannot forget the Family Islands and appreciate the fact that many of our visitors are not coming here with cash and so, education on digital payments and greater uptake is critical.”