No Bahamian should have to go to a politician to get a “fair shake”, Turnquest says

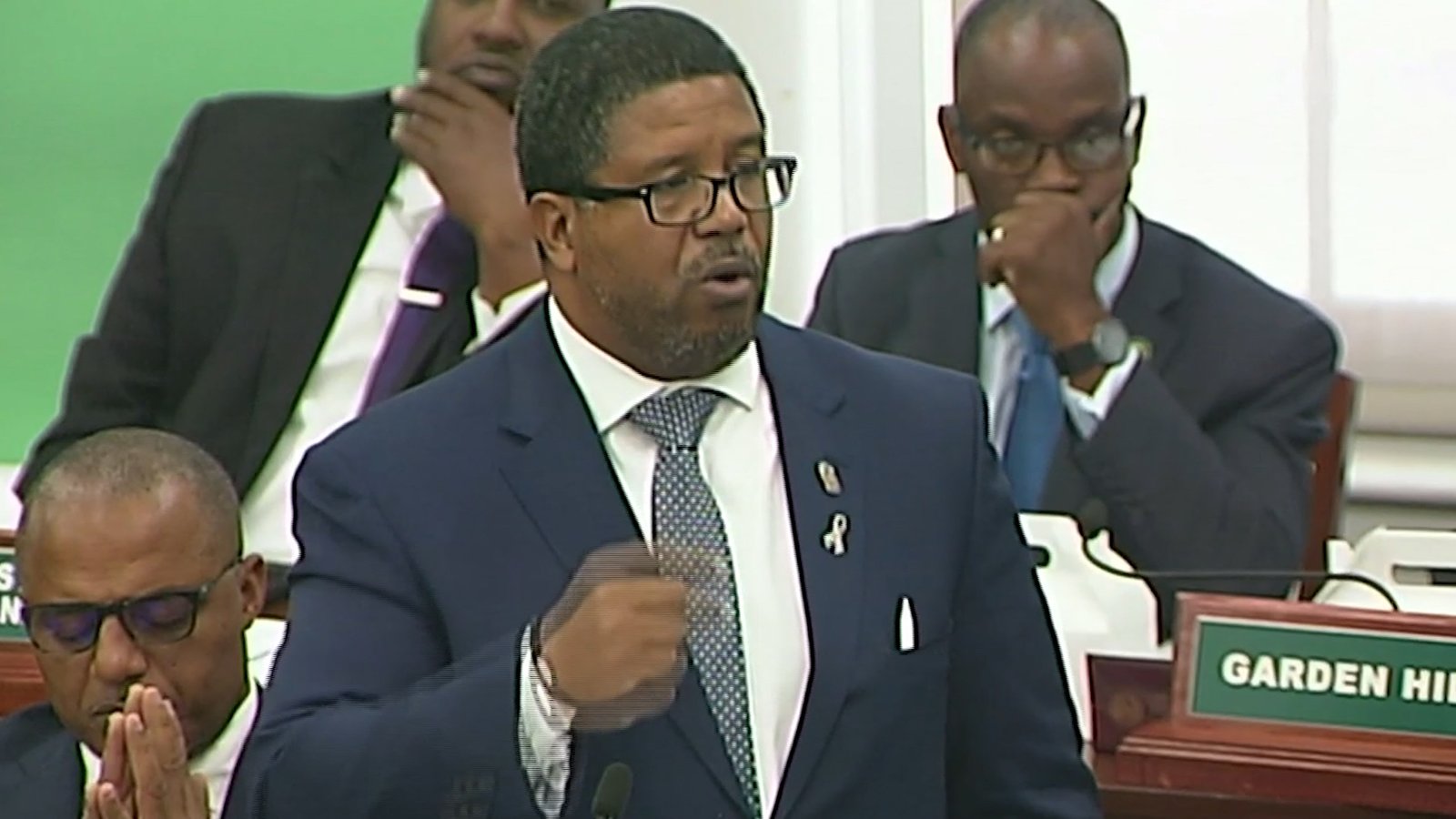

NASSAU, BAHAMAS – As he outlined initiatives undertaken by the Minnis administration to cultivate a more prosperous environment for small businesses in The Bahamas, Deputy Prime Minister and Minister of Finance K. Peter Turnquest yesterday urged more commercial banks to commit to do more to provide “tangible support for microfinance and small businesses”.

“To date, the Bahamas Development Bank, the Bahamas Entrepreneurial Venture Fund, and two commercial banks have joined in as funding partners in this initiative,” he said during the budget communication in Parliament.

“While I am pleased about that, I expect to see all commercial banks committing to do much more to provide tangible support for microfinance and small businesses in The Bahamas, either through the government’s loan guarantee initiative or through their own programs.

“They must realize, as I do, that to build their marketplace of large commercial clients, they have to plant the seeds that will allow today’s entrepreneur and small business to become the strong vibrant multi-million-dollar business client that they all seek.

“I put the banks on notice that I will be meeting with them collectively to discuss this issue to consider the options for requiring them at a minimum to publish and publicize their ongoing performance and portfolio make in respect to microfinance in the country and loans and facilities extended to Bahamian small businesses.”

In the upcoming budget, the government will expand its allocation to the small business sector to $8.5 million, up from $5 million in the previous fiscal year.

This includes capital and recurrent outlays.

According to the minister, the funds will be used to fund operation and grants, as well as to underwrite loan guarantees and provide equity financing.

He noted that the government will leverage the $8.5 million to provide up to $12 million in financing for Bahamian SMEs during the upcoming fiscal period.

Additionally, the government is considering a $25 million credit enhancement program with the Inter-American Development Bank (IDB) to continue to expand financing for MSMEs, Turnquest said.

He said, “The project is intended to boost economic activity by providing financing for small businesses as well as improving their business skills.

“These objectives are largely in line with the functions of the SBDC (Small Business Development Centre) and, as such, the SBDC will stand as the executing agency for the project, if approved.

As outlined by the minister, the project would involve two major components; a credit enhancement facility which would be administered by the SBDC to facilitate financing of SMEs and strengthening the SBDC’s program for advisory and technical assistance.

Turnquest said the government is focused on breaking the cycle of dependence of government, which requires it to empower citizens and facilitate growth and expansion, particularly in the small business sector.

The government has approved funding for 13 business collectively totaling just under $1 million in grants, equity and loans, according to the minister.

To date, more than 3,500 small businesses have registered with the SBDC with approximately 73 percent accounting for startup businesses.

The remainder of businesses registered were existing companies.

The SBDC has approved $87,500 in grants, $205,000 in equity, and $652,500 in government guaranteed loans.

Turnquest insisted that no Bahamian should feel they have to go to a politician to get a “fair shake in their own country, and said the systems the Minnis administration puts in place should work for Bahamians regardless of party affiliation.