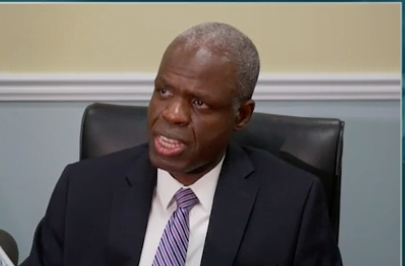

NASSAU, BAHAMAS — The country’s credit bureau is ‘up and running’, according to Central Bank Governor John Rolle, who noted the agency will be able to provide a ‘snap shot’ of a borrowers level of indebtedness.

Speaking at a press conference at the Ministry of Finance yesterday, Rolle said: “The credit bureau is up and running and interacting with the banks and other stakeholders getting them prepared in terms of how they would submit information.

“We are not getting information yet from the credit bureau because the financial institutions have to go through the first phase of submitting data and that will happen in the first year of the bureau.”

Rolle continued: “There will be an initial snap shot to provide some upfront indication in terms of the credit worthiness of a lot of the borrowers. Even though it won’t have the historical track record it will provide the opening snapshot.

“One of the near term things we have to do is make sure some of the other non-banks such as the utility companies are enlisted do they can prepare to report to the credit bureau. The consultative process has begun but there is also a regulatory step that is necessary.”

A credit bureau effectively acts as a central database that lenders can use to obtain a more complete, accurate picture of the risk and creditworthiness presented by a particular borrower.

CRIF, a leader in the provision, management, and operation of credit bureaus worldwide, officially launched its operations for the creation of the country’s first credit bureau back in January.

Rolle said: “It will give a snap shot of where you are. The bureau may not have the most accurate information in terms of how faithful you were in paying on time etc but it will no how much debt you have and that indicator says a lot.”