Mortgage disbursements for new construction repairs drop further 13 percent

NASSAU, BAHAMAS – Domestic private sector activity in the residential and commercial construction segments remains “subdued”, according to the Central Bank, with total mortgage disbursements for new construction and repairs dropping a further 13 per cent.

In its Quarterly Economic Review for the second quarter of 2019, the Central Bank in noted that while output in the construction sector “continued to be supported by ongoing varied scale foreign investment projects”, domestic private sector activity remained “subdued”.

“As an indicator of private domestic activity, total mortgage disbursements for new construction and repairs — as reported by domestic banks, insurance companies and the Bahamas Mortgage Corporation — fell by a further 13.1 per cent ($4.1 million) to $27.2 million, after a 15.9 per cent decline in the previous year,” the Central Bank.

“In terms of the components, the dominant residential segment contracted by 9.2 per cent to $26.2 million, after 2018’s 11.9 per cent reduction. In addition, commercial disbursements decreased by $1.5 million to $1.0 million, extending the $1.1 million falloff in the prior period.”

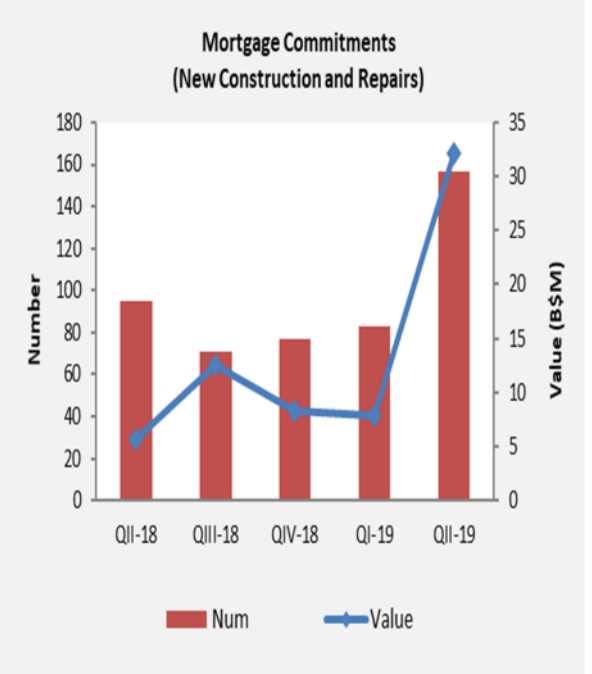

The bank noted, however, that indications are that the sector could record some improvement in the near-term, as mortgage commitments for new buildings and repairs (a forward-looking indicator) rose by 62 to 157, while the corresponding value firmed by 73.2 per cent to $32.1 million, over the prior year.

“A breakdown of the categories, showed that undisbursed approvals for the dominant residential component, rose in number by 58 to 153, while the corresponding value more than doubled to $24.6 million from $8.6 million.

“In addition, four new commercial approvals were disclosed for the quarter, valued at $7.6 million, compared to unchanged levels in the prior year. With regard to interest rates, the average financing cost for commercial mortgages narrowed by 52 basis points to 7.23 per cent. Similarly, the average rate on residential loans softened by 36 basis points to 6.84 per cent,” the Central Bank reported.