NASSAU, BAHAMAS – The country’s external reserves are currently near $2.3 billion according to the Central Bank, with its data revealing that inflows from foreign investments, tourism and other export earnings contracted by almost one-third over the first nine months of the year.

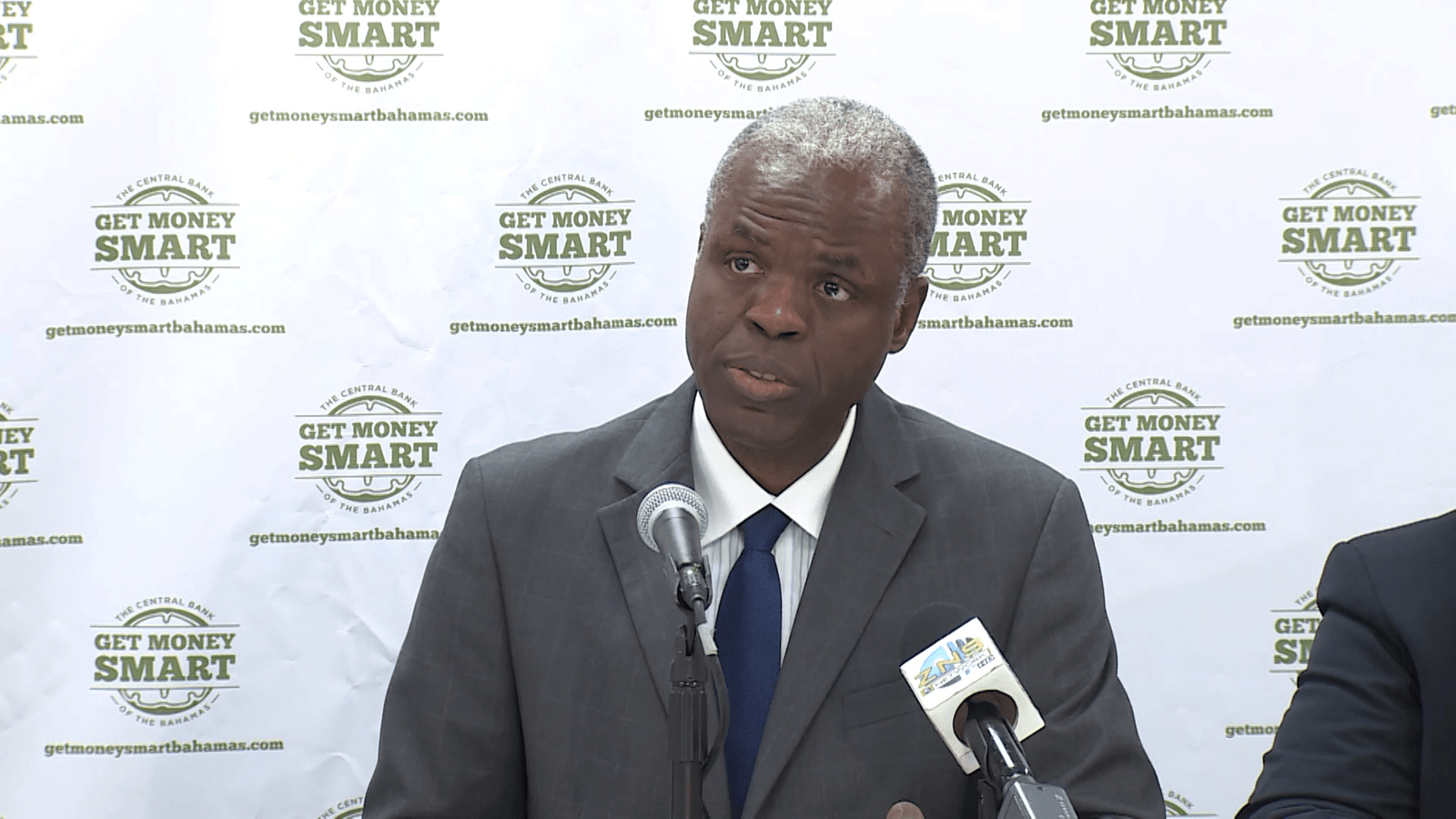

Central Bank Governor John Rolle yesterday noted that through the end of the third quarter of 2020, external reserves stood at $2.1 billion.

“At the start of November, balances were nearer to $2.3 billion,” he said.

“With the latest inflows, the reserves are now expected to end 2020 higher than they were in 2019. That said, the projected near-term reduction in holdings has only shifted into the first half of 2021.”

Rolle added that managing foreign exchange usage is one of the regulator’s top policy priorities.

“Exclusion of access to foreign exchange for non-essential uses is the prudent stance that the Central Bank expects to maintain, at least the first half of 2021, and potentially longer, if the recovery is too delayed or subdued,” he said.

“This particularly applies to the moratorium on financing of portfolio investments outside The Bahamas, and the wider margin within which commercial banks have been required to trade in foreign exchange before they can replenish supplies through the Central Bank.

“The moratorium on commercial banks dividend payment outflows also continues, although this policy could be reassessed earlier, in the first quarter of 2021.

“The economic environment still does not leave scope for expansionary monetary policy. Such would only accelerate use of the external reserves.

“Instead, the Central Bank’s posture is to selectively accommodate increased credit to businesses and households, but paced alongside any strengthening outlook for foreign exchange earning activities.”

According to the Central Bank Governor, the regulator’s data on foreign exchange transactions, which he noted are a good barometer of private sector activity, revealed that over the first nine months of 2020, inflows from foreign investments, tourism and other export earnings contracted by almost one-third.

“The demand for foreign exchange to pay for imports and other external obligations fell by nearly 15 percent; still placing the reduced usage more than $750 million higher than private inflows. As intended, proceeds from the government’s foreign currency borrowing have helped to cover this difference, in a manner consistent with the public sector’s sizeable role in stabilizing domestic consumption,” Rolle added.