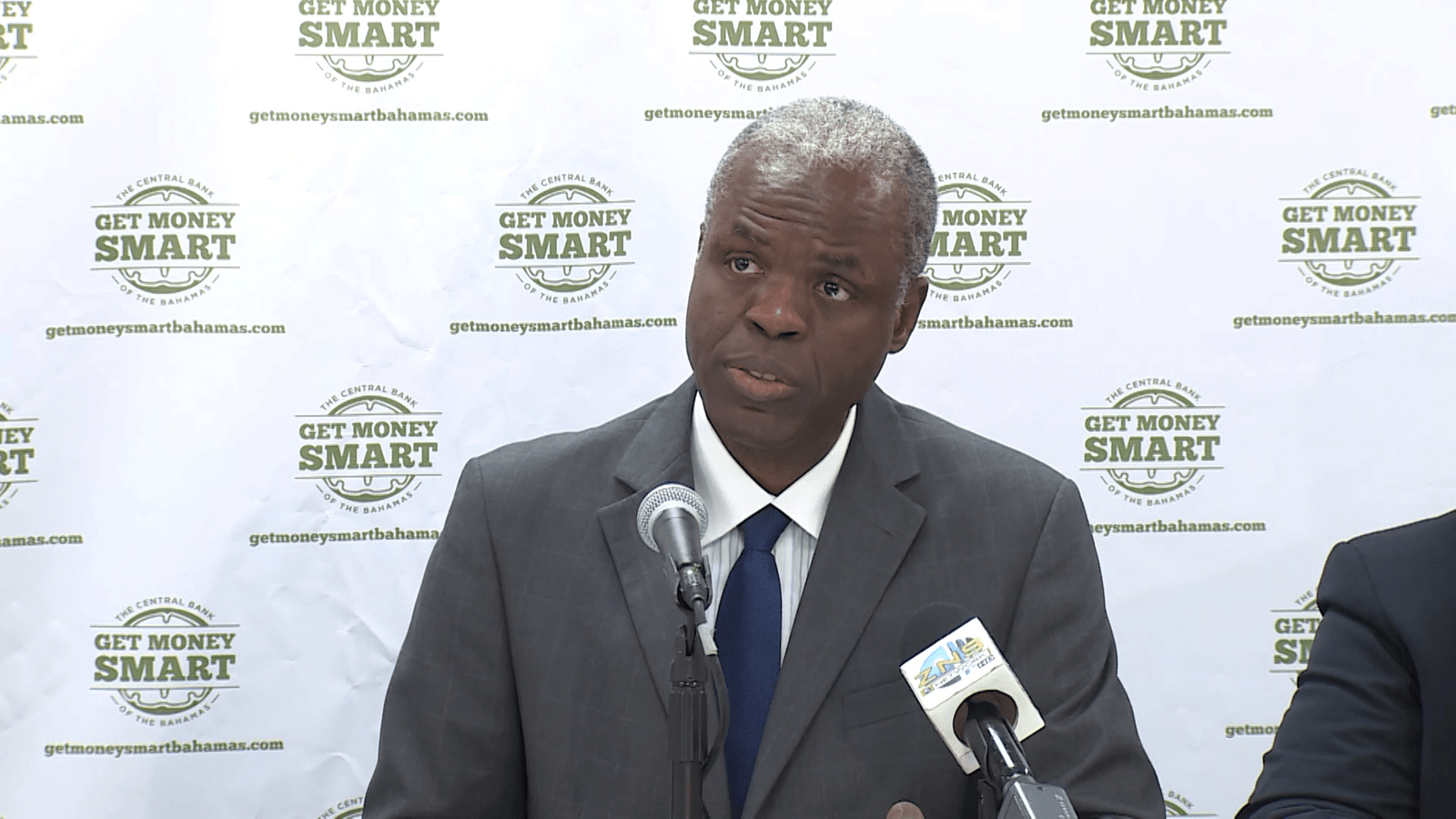

NASSAU, BAHAMAS – The Central Bank is exploring whether to bring about an early introduction of digital Bahamian currency on Abaco to enable rapid financial service recovery Central Bank Governor John Rolle said yesterday.

Governor Rolle who was addressing the Exuma Business Outlook noted that the banking sector particularly on Abaco had been significantly impacted by Hurricane Dorian.

“One of the main outcomes of the hurricane on country’s banking sector banking sector was significant damage to physical banking structures on Abaco and Grand Bahama which also shut down operations on those islands. Critical to restoring a sense of commerce on those islands will be the timely resumption of banking services,” said Mr Rolle.

He continued, “The Central Bank has begun to explore whether an early entry to project Sand Dollar into Abaco would be feasible. Some indications are there is some feasibility to that. It won’t step on Exuma’s toes but will allow us to test aspects of the emergency wireless feature that would enable rapid financial service recovery and to connect with many retail businesses early in their recovery. The San Dollar infrastructure is being designed to connect with bank accounts so that remote access to those facilities would be quickly enabled for deposit and withdrawal needs in the case of any disruption.”

Exuma has been selected as the first island to test the digital currency called Project Sand Dollar. NZIA Ltd, a joint venture between IBM and a Singapore-based software company specializing in blockchain solutions, was selected from among 30 bidders to be the preferred technology solutions provider for the project.

The digital currency roll-is a key element in the Central Bank’s drive to modernize The Bahamas’ payment system, move consumers away from reliance on cash to electronic payments, and improve access to financial services – especially in remote Family Island communities.