NASSAU, BAHAMAS — As Bahamas Petroleum Company (BPC) continues to face strong opposition from local and US environmental groups, one of its financiers is now expressing “regret” over involvement in facilitating funding for the company’s offshore oil exploration activities.

Lombard Odier, a Swiss private bank, in a brief response to Eyewitness News’ inquiries, said: “We regret this situation and are taking the necessary actions to address it. This investment decision was not aligned to our commitment to sustainability and our strategic investment framework.”

The history of BPC’s funding strategy indicates that on December 14, 2020, the company entered into a funding agreement with an institutional investment fund managed by Lombard Odier Asset Management. Under the funding agreement, a fixed number of 375 million shares was issued to the Lombard Odier Asset Management to secure $10 million in immediately available funds.

At that time, BPC also entered into a “funding option agreement” with the investor, under which BPC was granted an option to place a further fixed number of up to 187.5 million shares to the Lombard Odier Asset Management to raise up to a further $5 million. The investor could also opt to double that amount and provide a full $20 million.

BPC began drilling its exploratory well on December 20 and has indicated that Bahamians could learn in a matter of weeks if The Bahamas is an oil-rich nation.

A Supreme Court judge has granted environmentalists leave to seek judicial review of the government’s approvals for BPC to drill an exploratory well in Bahamian waters. The judge also ruled that Save The Bays and Waterkeeper Bahamas Limited have “an arguable case”, but denied the applicants’ application for a stay of the ongoing drilling exercise.

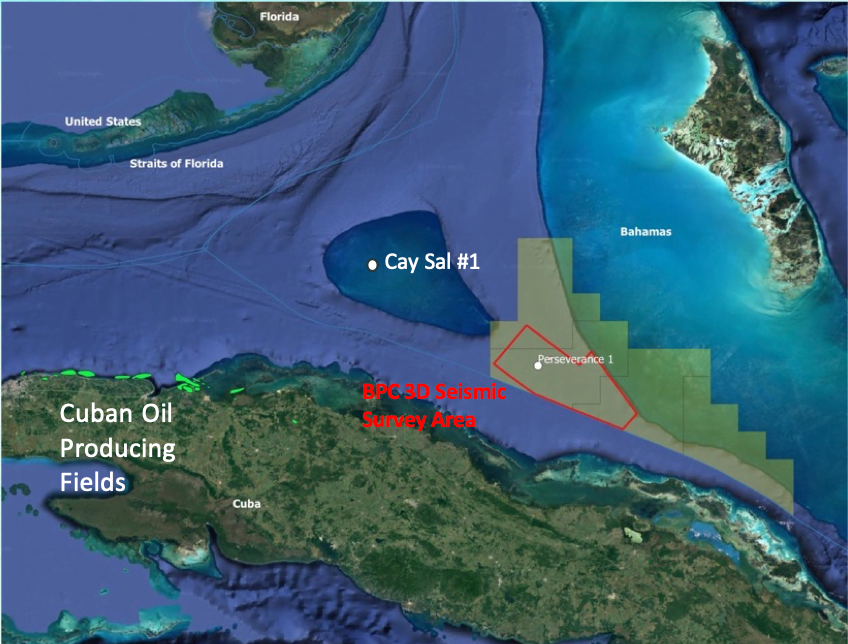

BPC’s finances, and whether it has sufficient funding to complete the Perseverance #1 exploratory oil well in waters 90 miles west of Andros, is an issue that was raised in the judicial review challenge.

Oil exploration opponents have argued that BPC lacked sufficient funding and insurance for its first well — claims the company has strongly denied.

The estimated total cost of Perseverance #1 is in the range of $24 million to $28 million, with identified contingencies of up to $7 million.