NASSAU, BAHAMAS — Banking lending conditions showed improvement over the latter half of 2023 according to the latest quarterly bank lending conditions survey results released by the Central Bank.

The regulator noted: “The Central Bank’s most recent survey of commercial banks showed that bank lending conditions continued to improve and the demand for credit increased during the latter half of 2023, relative to the same period in 2022. Mirroring these trends, the total number of applications received grew, supported by consumer loan requests. Further, the rate of approval on loan applications trended upward. Meanwhile, the main reasons cited for personal credit denials at lending institutions were high debt service ratio (DSR), insufficient time on the job, and underemployment.”

According to the survey, loan applications received were 16,418, up 2.4 percent from the six months to December 2022, and applications approved were 13,562, up 4.6 percent from December 2022. Loan denials at 1589 were down 10.7 percent.

It was also noted that during the six months to December 2023, lending institutions processed 778 residential mortgage applications, representing 99.1 percent of the total mortgage applications received.

Residential mortgage applications,, however,, contracted by 14.6 percent year-on-year, a slowdown from the 21.6 percent decline in December 2022. Reductions were recorded for all three major categories: new construction (27.3 percent), existing dwellings (12.7 percent), and rehabilitations and additions (8.5 percent).

Total residential mortgage applications declined by 14.6 percent year-on-year; however, the approval rate increased notably by 14.9 percentage points, to 52.9 percent, over the same period in 2022, according to the Central Bank.

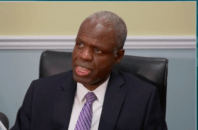

Central Bank Governor John Rolle dismissed suggestions that the Credit Bureau was having any adverse effects on the country’s lending environment, describing the credit environment as still “very soft.”

Central Bank Governor John Rolle dismissed suggestions that the Credit Bureau was having any adverse effects on the country’s lending environment, describing the credit environment as still “very soft.”

“I would not say we are seeing any adverse effects from the credit bureau at this stage. The credit environment in the Bahamas is still very soft, but that is just an accumulation of experience up to this point, which was independent of the credit bureau. The credit bureau puts these institutions in a better position to sort out potential risky borrowers going forward,” Rolle said in response to questions at a press conference regarding this Monthly Economic and Financial Developments report for March.

Rolle noted that the credit bureau gives lenders a clear opportunity to identify those borrowers who would merit access to more credit. He noted that while the commercial banks have signed on and are using the information compiled by the credit bureau, the regulator is still working to get non-bank credit providers onboard.

“We’re making good progress in getting non-bank providers of credit to sign up; that includes insurance companies, and money lenders that are licensed and regulated through the Securities Commission. It also includes the public utilities. We think it is very important to get the group onboard. The banks and credit unions are ahead of the process. Commercial banks are already using information compiled through the credit bureau to help guide their lending decisions. That means the bulk of the sources of credit are already being tracked but you do need to pick up on all of those other areas to have a complete picture. We also want those other commercial operators to understand the value of using the credit bureau to help also guide how they may be managing their credit exposure of individuals and businesses,” said Rolle.

Governor Rolle also noted that work continues to progress toward the establishment of a collateral assets registry. “We are very happy with the work that is going on around the preparation for the collateral assets registry. We have had a lot of exchanges with the Attorney General’s Office and a part of that conversation was to be very clear as to where the responsibility for the register would rest. We came around to supporting the idea to allow the registrar general to take that on because some other improvements are happening at the Registrar General’s Department both in terms of new investment in technology, there are some other registries the government is implementing and so from a technology point of view and efficiencies of using the same platform there was an opportunity to move in the same direction,” said Governor Rolle.

He added: “Right now what is important is to have the legislation enacted since the Registrar General’s work is already focused on building out new digital registries this fits right in with their work plan.”

He noted that the registry would allow a broader range of creditors to operate within the private sector with particular benefit to businesses, particularly in the enterprise sector.

Creating such a registry, viewed as a complement to the upcoming Credit Bureau, would enable lenders to record and secure their interest over vehicles, intellectual property, and other mobile assets that could be pledged as loan collateral. The driving motivation behind the proposal is thus improving Bahamians’ access to credit by enabling potential lenders to properly perfect and secure collateral – something they often struggled to do with such assets in the past.