NASSAU, BAHAMAS — Central Bank Governor John Rolle said yesterday that it is expected that the Bahamian economy could be fully recovered from the economic shock of the COVID-19 pandemic over the course of next year, possibly slightly ahead of earlier projections.

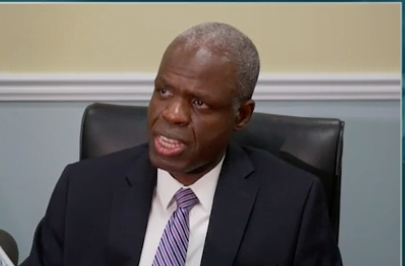

Rolle was addressing the regulator’s monthly economic and financial developments report for March 2022 at a press briefing.

“It is expected that the economy could be fully recovered over the course of next year—that is 2023—possibly slightly ahead of the projections made at the end of 2021,” he said.

“That said, there continues to be a distinction between recovery from the low point of the pandemic—for which the falloff in the economy was quite drastic—and the still very mild annual growth projections that lie beyond the recovery phase.”

Rolle noted that the Bahamian economy faces important downside risks from the shift in policies in the United States and other major countries fighting inflation, and the strain placed on the global economy by the war in Ukraine.

“For the near-term, though, it is expected that tourism will continue to benefit on net from release of pent-up demand carried over from the travel lockdown phase,” he said.

Rolle noted that the first three months of the year marked the first January to March quarter of undisrupted business since 2019.

He continued: “Based on airport departure data—a good benchmark for the stopover sector—quarterly visitor volumes appear to have regained about 75 percent of the traffic experienced in the same period of 2020, which had been spared the brunt of the lockdown. However, this still leaves important gains to be recouped before the 2019 pre-pandemic base-line for the winter season would be eclipsed.”

Rolle said: “Vacation rental market indicators were also broadly improved, in terms of increased occupancy levels and higher average nightly room rates. Recent trends have also been characterized by an expanded share of the business going to the Family Islands, where more than half of all listings were noted; and the average occupancy rates trended higher than in New Providence and Grand Bahama.”