NGO says govt must now focus on wider issues, namely women representation in leadership

NASSAU, BAHAMAS — While applauding the government for removing value-added tax (VAT) on feminine hygiene products, the Caribbean Women in Leadership (CIWiL) Bahamas Chapter said yesterday there must be a continued focus on women’s issues in The Bahamas, including addressing the disproportionate representation in leadership.

“Research has shown that COVID-19 has disproportionately impacted women more than men, particularly in The Bahamas where single mothers lead a significant percentage of our homes and bear an unequal burden of care for our children,” said CIWiL Chair Charlene Paul, when contacted.

“Women, therefore, need more support.

“Studies have further confirmed that it is only when women are sufficiently represented at decision-making tables that women and girls’ issues are more fully addressed.”

Paul pointed out that women in the Caribbean remain underrepresented in national and regional decision-making and “continue to face various barriers in accessing leadership spaces”.

“Gender equality at the highest levels of leadership can be achieved,” she said.

“CIWiL continues to [call on] women and men all over the Caribbean for the sustainable and transformational development of our region, and particularly to remove the structural barriers to women’s full and equal participation.

“We join with the international community in continuing to call for increased participation of women in leadership and decision-making, which is key to achieving gender-equitable outcomes for our societies.”

The organization called on the government to prioritize gender parity and to adopt gender-inclusive and gender-sensitive legislation and policies in all areas of decision-making and leadership.

Meanwhile, Maelynn Seymour-Major, a long-term activist of women’s rights, said: “This is a great start. They’re duty-free and they’re VAT-free. I hope that the country sees this as the bold move that it is because it is also saying that women aren’t being taxed for being women. We have no control over having periods and so it is nice that these items are finally are VAT-free in addition to being duty-free.”

Seymour-Major agreed that more women and more diversity are need around the leadership table at every level.

“When you have more diversity at the table — gender, race, age — we make better decisions the first time out and a decision like that just seems to be a no-brainer for me, along with the breadbasket items being VAT-free,” she said.

“So, I am very happy…”

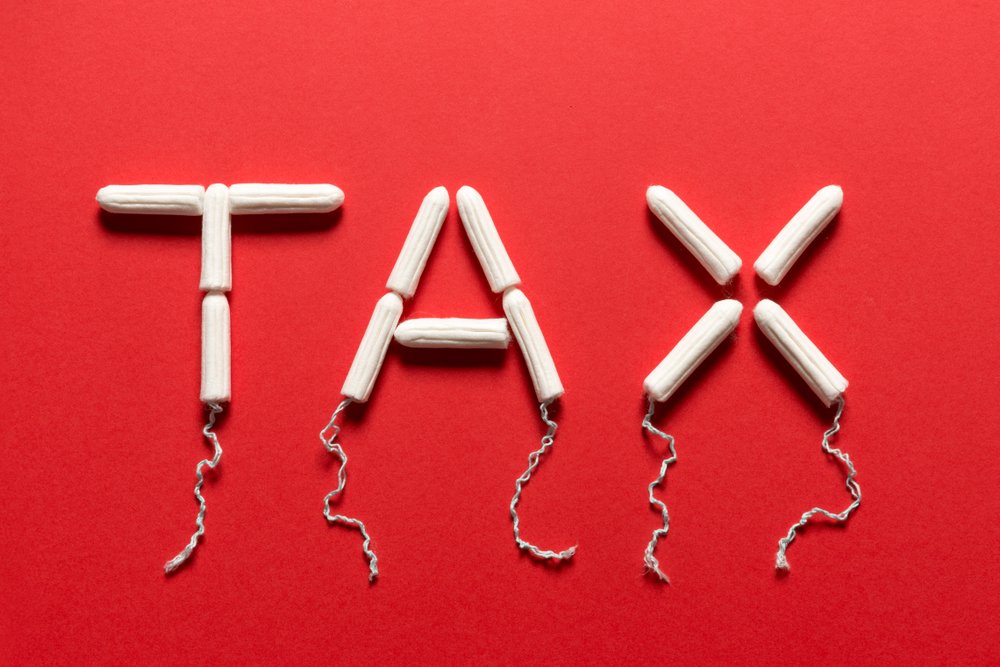

In June 2018, a petition to eliminate the tax in The Bahamas on feminine hygiene products, including but not limited to tampons, menstrual cups and sanitary pads, received nearly 13,000 signatories.

While VAT was exempted from breadbasket items — items the government considered essential — feminine hygiene products were not among them and have been subject to the 12 percent tax since July 1, 2018.

Seymour-Major, who launched the petition, said the removal of the tax on these essential items was the “best news I’ve heard all day”.

The Bahamas’ move to eliminate VAT on feminine hygiene products comes just months after the United Kingdom abolished the “tampon tax” on women’s sanitary products, with a zero rate of VAT.

The tax was abolished on January 1, 2021.

European Union laws have seen sanitary products subject to different rates of VAT since 1973, the latest of which was five percent, effective January 2001.