NASSAU, BAHAMAS — The Central Bank is still actively seeing to improve what still remains a “less than satisfactory” experience in opening accounts at domestic banks according to Governor John Rolle, noting that the target is to reduce the average time it takes to open a business account to less than two weeks.

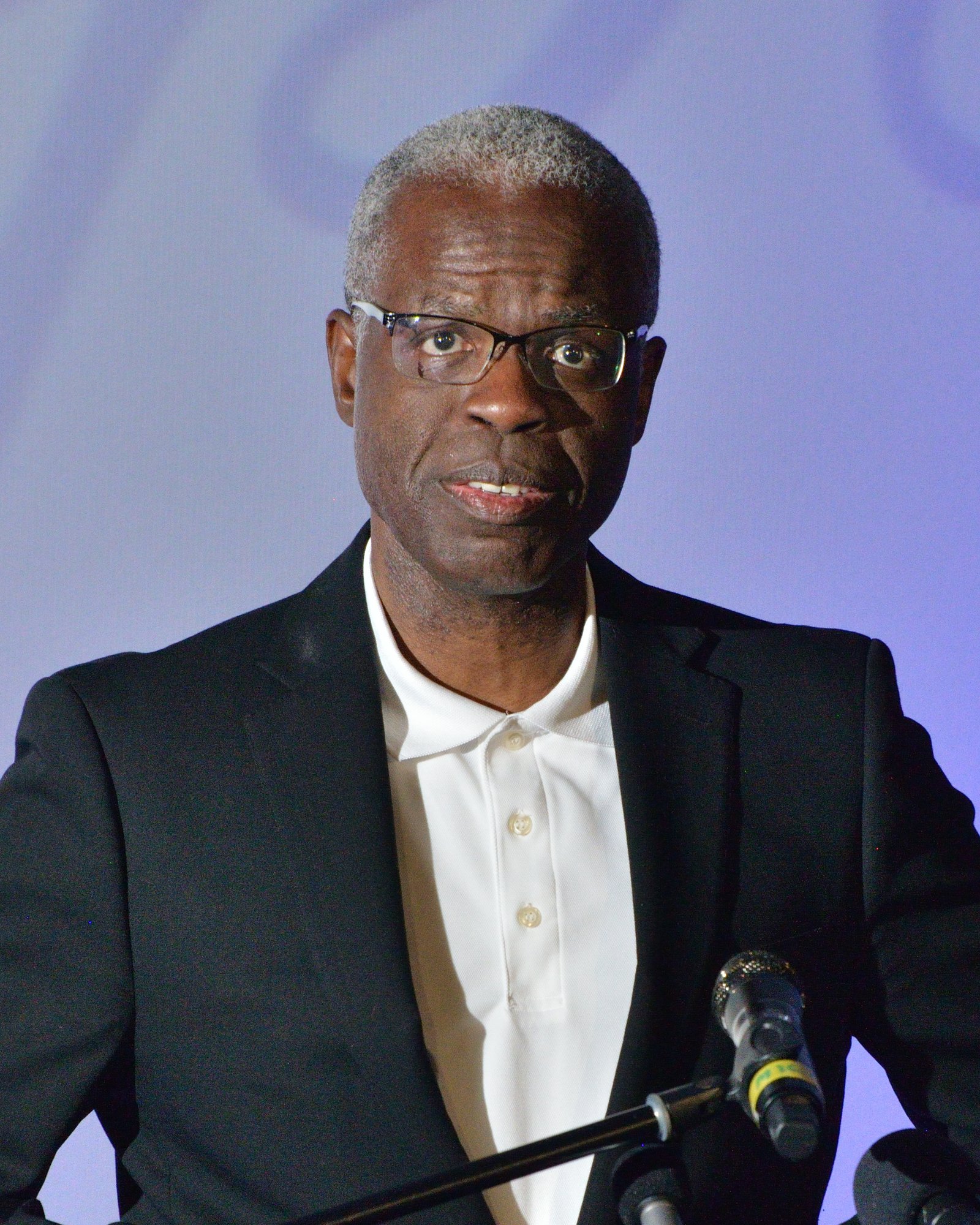

“The Central Bank is actively pushing to improve what still remains a less than satisfactory experience in opening accounts at domestic banks, including for businesses; and banks have taken on the task to identify reformed practices, changes in government policies and Central Bank regulations that could specifically reduce the average amount of time it takes to open a business account,” said Rolle while delivering remarks at the opening of the regulator’s recent Financial Literacy Fair and Digital Expo.

“The target is to reduce the average experience to less than two weeks. Feedback from the business community is that it is now taking [much] longer than this on average to conclude the process.”

Rolle continued: “Regarding the personal banking experience, in the last month, there has been further easing of the “know-your-customer” or the KYC requirement, so that a Bahamas driver’s license is sufficient ID, by itself to open a bank account for low-risk clients. This characterizes the substantial majority of persons who present themselves to open a deposit account.

Rolle continued: “Regarding the personal banking experience, in the last month, there has been further easing of the “know-your-customer” or the KYC requirement, so that a Bahamas driver’s license is sufficient ID, by itself to open a bank account for low-risk clients. This characterizes the substantial majority of persons who present themselves to open a deposit account.

“Similarly, in some cases, individuals can now use their expired Bahamas passport or their expired Bahamas driver’s license to supplement lesser forms of official IDs that they might use. In the extreme, where photo IDs are not available, the Central Bank has affirmed again. that, domestic banks, credit unions, MTBs and payment services firms can still rely on written references from trusted sources, where there is potentially a low risk of money-laundering associated with the account.”

Underscoring the need for financial literacy, Rolle said further: “The more we know about financial products and sound practices the more we are empowered to use them. From a business perspective, literacy can help drive increased demand for financial products and services, and allow consumers to communicate in more informed ways about the products and services which matter to them.

“From a government perspective, positive personal financial behavior, empowered by literacy, can also over time remove more families off direct dependence on government support, and allow the government to channel more resources to other productive sectors within the economy.

“ From the Central Bank’s perspective, the informed consumer also has to understand how the Bahamian economy and the financial sector work. This would help them to better articulate the demands made of the government, regulators and financial institutions, and to understand how the environment in which the government and financial institutions operate affects how both government and businesses can respond,” Rolle remarked.

Economic Affairs Minister Michael Halkitis noted that the government has undertaken a number of initiatives geared toward financial literacy, improving access to technology and financial inclusion. “We are committed to digital transformation through our Digital 700 campaign which is poised to provide transformational opportunities through various sectors,” Halkitis said.