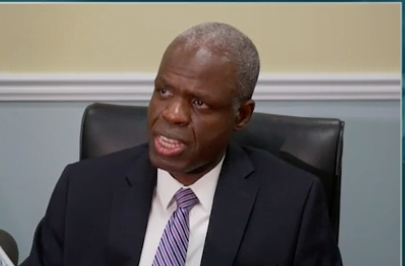

NASSAU, BAHAMAS — Losing the country’s fixed exchange rate peg with the US dollar is ‘not an option’ for a country like The Bahamas, Central Bank Governor John Rolle said today, noting that adjustments will be made where necessary to maintain that equilibrium.

Governor Rolle was speaking on the regulator’s monthly economic and financial developments report for June.

He said: “Losing control of the peg is not an option a country like The Bahamas. The adjustments will be made where ever else they need to be made so that we maintain that equilibrium.”

Rolle also noted that the country’s external reserves remain “adequate” to fully support the value of the Bahamian dollar fixed exchange rate, even with a sizable reduction still expected over the remainder 2020.

“This continues to underscore the importance for the Government to preserve its access to international capital markets to help finance the deficit as it moves to stabilize the economy; and for the Government to adopt prudent reforms that would raise market confidence,” he continued.

“It also highlights the value of the direct conservation measures adopted by the Central Bank in April to protect the foreign reserves, while the emphasis remained on targeted credit support and forbearance for businesses and households experiencing direct hardship.”

Rolle further noted that the Central Bank has not yet seen the amount of reliance on private sector deposits that were earlier projected.

“Higher spending against such withdrawals would also have been a pressure point on the foreign reserves,” he said.

“It is likely, though that the families most encountering employment hardships are those least likely to have saved meaningful amounts ahead of the economic crisis.

“This reinforces the Central Bank’s message on the importance of making households more financially resilient; the need to encourage and provide more means for families to save ahead of financial setbacks; and to proactively limit the consumer debt burden that persons ordinarily take on.”

Rolle said the bank has not deviated from its foreign reserve level projections for the year.

“We still believe the reserves could be drawn down to a level close to a billion dollars. It’s really in the latter months where you would see inventory restocking and a higher amount of spending against the reserves ordinarily.”

Back in May, the Central Bank announced that it was eyeing in excess of $300 million in ‘buffers’ as it outlined several measures to restrict foreign currency outflows.

The regulator suspended all approvals for Bahamians seeking to invest in foreign securities and real estate and also requested that the National Insurance Board (NIB) liquidate some of its overseas investments.

The Central Bank also put a halt on Canadian-owned bank dividend remittances and a more relaxed margin to sell foreign exchange to the public.

“What we did was give the commercial banks at least $100 million extra space in terms of their ability to source foreign exchange from other sources. We believe we would have gotten the full effect of that benefit,” said Rolle.

With regards to NIB, he said: ”We believe the full amount of that would have come in in the second quarter. The figure would have been in excess of $100 million.”

With regards to portfolio investments, Rolle added: “On the portfolio investments on an annual basis we were beginning to approach a level in range of $60-$80 million. That would have likely been the impact this year. In banking sector there was easily $100 million in dividend outflows in an ordinary year.”

Maybe that’s why all the money transfer houses were ordered closed this morning?