BPL says it had sought Cabinet approval to market revised rate reduction bond before August

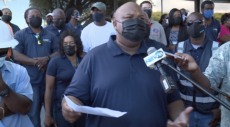

NASSAU, BAHAMAS — Kyle Wilson, the Bahamas Electrical Workers Union’s (BEWU) president, told Eyewitness News he was happy Bahamas Power and Light’s (BPL) rate reduction bond (RRB) does not appear to be on the agenda of the Davis administration.

“I am happy and glad that the prime minister would have taken that course,” said Wilson.

“I am not a proponent of the rate reduction bond in any which way. I think it’s a drawback to the Bahamian people.

“We are talking about borrowing hundreds of millions of dollars to build a plant to give to Shell North America, who is almost a multi-million conglomerate.

“What is the benefit to the Bahamian people for all those millions of dollars?

“I am happy that rate reduction bond has been placed on hold or eradicated. I hope it’s eradicated because I don’t think that was in the best interest of the common Bahamian person, who is going to have to pay higher taxes just to accommodate a billion-dollar conglomerate.

“I never got the gist of that. The union had no say; the union was in the dark.

“We made many attempts to find out what the labor component was attached to this deal. I was told by board members it was none of my business and…there were labor laws to take up if I had an issue.”

BPL speaks up

BPL had sought Cabinet approval for a revised RRB to go to market before August of this year, the company said in a statement on Sunday night.

It noted that the delayed offering has been considered the optimal solution to eliminate the company’s legacy debt and allow for much-needed infrastructure investments.

It also noted that the fire at Clifton Pier in September 2018 and the loss of approximately 70 MW of generation assets forced a shift in focus on the execution of the bond, which was delayed until the spring of 2019.

“The matter of the RRB was taken up by the board in the spring of 2019 with the creation of an international request for proposal (RFP) process managed by Ernst & Young,” the company noted.

“Following carefully considered responses to the RFP, Citi was selected as the lead book runner and ultimately responsible for taking a Rule 144a RRB transaction to market. FCIB was selected as the lead local arranger to secure local participation in the offering.

“Early in the process, following a detailed review of the 2015 rate reduction bond legislation, the legal firms involved agreed that the current legislation was not purpose-built for a 144a RRB offering, and as such, amendments would be required before the bond could be offered in the local and international markets.

“The lawyers determined that the required amendments were material and extensive. As a result, a decision was made that it would be best to repeal the 2015 legislation and replace it with the 2019 Rate Reduction Bond Act.

“The Cabinet of The Bahamas approved a bond quantum of $535 million. Given a bond of this size, and the fact that it would be an initial offering of a bond of this type, the fees associated with this offering were expected to be in the range of approximately two percent to three percent of the total quantum, or $10.7 million to $16 million. This is typical for a bond of this size.”

The company further noted that the 144a offering documents were completed in February of 2020, rating agencies were engaged and indicative feedback of an investment-grade rating received.

According to BPL, Citi indicated that it intended to take the bond to market in the spring of 2020, however, due to the onset of the pandemic in March 2020, the world financial markets became unstable.

Additionally, the pandemic dramatically affected the Bahamian economy, severely impacting local market conditions.

“The RRB offering was subsequently put on hold until the markets became more favorable for the RRB offering. This was done to ensure that the Bahamian people get the best possible price for the RRB offering,” the company noted.

BPL went on to note that Citi was asked to conduct a market sounding exercise in the summer of 2020, and it was discovered that there was only interest in the RRB at significantly higher interest rates, and it would be very difficult to fully subscribe the offering with the established bond quantum.

“Recognizing that carrying out a successful 144a transaction would not be possible in 2020, the financial advisors and book runners recommended a new structure that included privately placed loans and local bonds,” BPL noted.

“This structure would be more favorable to the market, and as such, a market sounding was conducted to determine feasibility.

“This market sounding was done by FCIB, and it was determined that there was interest in the transaction that was commensurate with the $535 million bond quantum, with an interest rate that was very favorable and comparable to the initial modeling of the RRB costs.”

BPL noted that all legal amendments and offering documents for the revised bond offering were completed in June of 2021.

“BPL, along with the Bahamas Rate Reduction Bond Company Limited (BRRBL), went to the Cabinet to seek approval for the required amendments so that the bond could be offered to the market before August of 2021,” the company noted.

“Unfortunately, Parliament was put in recess for the summer before the amendments could be introduced and passed in Parliament.”