NASSAU, BAHAMAS — The Central Bank has committed to work with the Ministry of Finance to establish a government savings bond scheme for small investors, according to Central Bank Governor John Rolle.

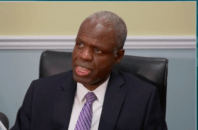

Addressing the Bahamas Business Outlook yesterday, Rolle said increased savings would expand the resources available for investment in business, infrastructure and growth.

“For small investors, the Central Bank has committed to work closely with the Ministry of Finance to establish a government savings bonds scheme, to allow savers to gradually build up holdings in government instruments, providing access to the liquidity that such assets provide and their competitive returns prospects,” said Rolle.

“Over time, a savings bond framework would be expected to moderately increase the share of the debt held by small retail investors, without giving the government any incentive to borrow more than it needs.”

He added: “The local capital markets will also have to continue to develop more collective investment opportunities for Bahamian residents. Infrastructure development is one area to target — within the public-private partnership frameworks, as are increased, strictly private ventures.

“Insofar as Exchange Control relaxation is concerned, the Central Bank will work further to increase domestic firms’ access to foreign currency financing, when the proposed ventures have positive impact on foreign exchange or if they are in keeping with other national development priorities.”

According to Rolle, outlets for international portfolio investments will also increase, as complements for improved domestic savings and could help encourage savings.

“For this, the Central Bank will stay focused on gradual Exchange Control liberalization,” said Rolle.

“Our recent accommodations have favored use of licensed trust companies, with the authorized agent status, as outlets for self-managed portfolio investments. However, progressive reforms will also be explored to promote increased use of BISX-listed depository receipts marketed by the local broker-dealer firms that finance purchases of securities listed on foreign stock exchanges.

“At present, access to foreign exchange is suspended for both sets of activities, but this is only a temporary measure, which does not prevent residents from trading in accounts already established.”

He added: “Converting savings into investments is also dependent on greater ease of access to commercial credit. For this, enhancing the security and transparency of domestic lending frameworks is vital.

“The Central Bank’s contribution includes an ongoing role in establishing the credit bureau. The bureau’s credit information reports will help to reduce uncertainties around the quality of potential borrowers, improving the medium and long-term access to both business and personal credit.

“The bureau, which was licensed at the end of 2019, is now setting up operations and should begin to produce live credit reports data by start of the second quarter of 2021. Commercial credit reports will start to be generated in a subsequent phase of operations.”

Rolle noted that the next initiative, on which there is already collaboration with the Ministry of Finance, is to set up a collateral registry for commercial lending.

“This would establish security against a range of movable, even intangible assets,” he said.

“The Central Bank will commission the consultancy on the diagnostic study for the registry in the first quarter of this year. This will produce an outline of recommended legal reforms to establish the registry; and a set of recommendations on the operational framework for the registry.”