“We had hoped for ‘instant gratification’ with Perseverance #1, which was not the case”

NASSAU, BAHAMAS — Challenger Energy executives said the company’s share price has declined markedly after it was revealed that its exploratory well in The Bahamas did not result in a commercial discovery.

The company, formerly known as the Bahamas Petroleum Company (BPC), noted that it would have folded as a result had it not expanded its portfolio of business.

Bill Schrader, the company’s chairman, in a message to shareholders in the company’s 2020 annual report, noted: “I feel it would be remiss of me if I did not at this point address ‘the elephant in the room’. That is, since the results of Perseverance #1 became known in February 2021, the company’s share price has declined markedly, and despite a lot of hard work by everyone in the company, there has not yet been the kind of operating success elsewhere in the portfolio required to offset that decline.”

According to Schrader, the company met its obligation to shareholders and the government of The Bahamas to drill Perseverance #1 within a defined time period.

“This obligation was met, and drilling was carried out safely and responsibly, despite the compounding uncertainties and unprecedented operating disruptions caused by the global pandemic, a last-minute legal challenge from environmental activists, mixed public messaging from government authorities and an unprecedented collapse in global oil prices.

“Individually, each of these impacts would have severely challenged companies with much larger resources, and it is thus a testament to the tenacity of the management team that drilling was nonetheless able to proceed.”

He also noted that a significant increase in share price would have inevitably followed had the drilling result been an unmitigated commercial success.

“In the end, this is the risk-reward equation that any investor in an exploration-focused oil and gas company assumes,” Schrader said.

He added: “Without the strategic shift to become an expanded portfolio business initiated in early 2020, and had the company not succeeded through the course of 2020 in executing on this strategy, the result of Perseverance #1 would unequivocally have meant the end of this company.

“Instead, shareholders continue to have a business, and there remain multiple opportunities to restore shareholder value.”

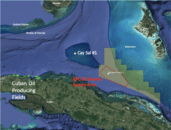

Eytan Uliel, CEO of Challenger Energy, noted that while Perseverance #1 may not have resulted in the commercial discovery the company had hoped for, a substantial amount of data and learning was obtained from the drill.

“We are still integrating all of this information, but it provides encouraging support for the possibility of a deeper Jurassic oil play,” said Uliel.

“As I have observed in other forums, we had hoped for ‘instant gratification’ with Perseverance #1, which was not the case. However, it is important to remember that in our industry, several exploration wells are often required before the potential of a frontier basin is unlocked, and based on what we have learned from Perseverance #1, we continue to believe that our licenses in The Bahamas are prospective.”

He noted that the company has shifted its focus to renewing the licenses into a third, three-year exploration period and securing a partner — ideally a large industry player — to provide expertise and capital for the next phase of activity.